The COVID-19 pandemic has impacted advertising spend, with food and government seeing the biggest increase in traditional advertising spend, whilst spend dropped significantly in travel, entertainment and telecoms (-15%), according to new data.

Nielsen today releases the latest traditional advertising spend figures in the UK for March 2020, the month in which COVID-19 hit the UK and lockdown began.

Advertisers spent a total of £412m on TV advertising in March, an increase of +4% YoY. Consumer goods companies Unilever (£10m) and Procter & Gamble (£9.4m) were the top two TV advertisers in March. Meanwhile, NHS England spent £3.9m on TV advertising, while the supermarkets Asda, Aldi and Tesco spent £3.7m, £3m and £2.1m respectively.

Key findings:

• Advertising categories where spend dropped the most in March were travel (-48%), entertainment (-17%) and telecoms (-15%)

• Food (18%) and government (22%) had the biggest increase in advertising spend YoY

• Advertisers spent a total of £412m on TV advertising in March, an increase of +4% YoY thanks to a strong start to the month prior to lockdown later in the month

In what was a difficult month for businesses across the UK and the world, advertising spend on traditional channels reflected both consumption changes and new behaviours from homebound consumers.

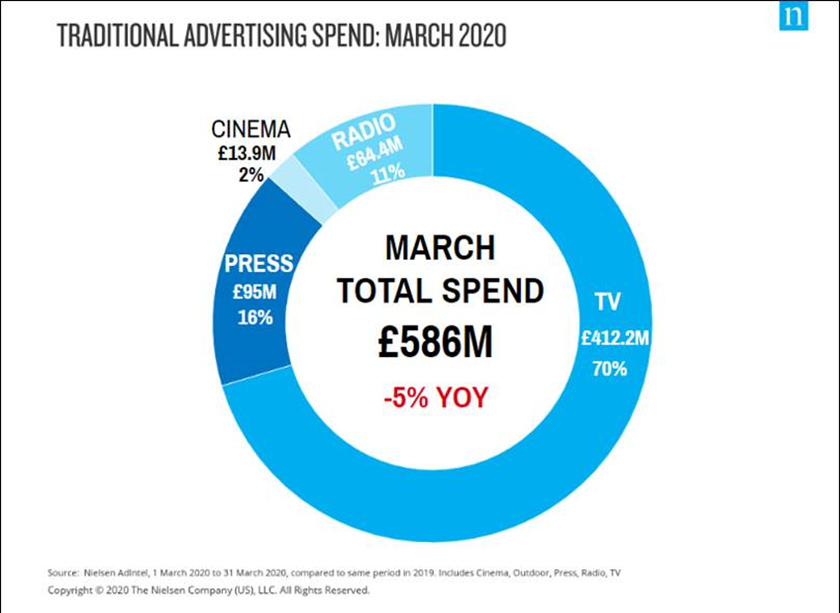

As COVID-19 hit the UK in March, total advertising spend on traditional channels – which includes TV, press, cinema, out of home and radio – was £586m, a decrease of -5% compared to March last year. The week of March 23, when the UK officially went into lockdown, saw a dramatic shift in advertising: spend on press fell by 38% to £15m, its lowest weekly figure in 2020. Following the temporary closure of cinemas nationwide, weekly spend on cinema declined by 94%, whilst spend on out of home (OOH) dropped by 22%, and radio declined by 20%.

Ad spend from the travel industry was the hardest hit (-48%) as fears began mounting early in the month, thanks in part to high-profile issues such as isolated cruise ships seeing rapidly rising COVID-19 infections onboard. Ad spend in the entertainment sector also dropped by 17%, and telecoms spend decreased by 15% year-on-year, perhaps a surprise given the increased reliance on remote communication. These losses were not fully mitigated by rises from other sectors such as food, for which ad spend rose by 18% (£8.4m), government which increased its spend by 22% (£7.5m) and computing which saw increased ad spending of 41% (3.7m).

With everyone in lockdown looking for ways to keep themselves occupied, sectors that cater to this ramped up their spend. During the week of 23 March, there was an increase in advertising spend for online retailing (+208%), mail order (+40%) and leisure equipment (+37%) as companies sought to sell products to time-rich housebound consumers.

While overall ad spend decreased, TV spend in March actually held up and increased by 4% to £412m for the total month, accounting for 70% of total advertising spend. Nielsen data reveals that consumer goods companies Unilever (£10m) and Procter & Gamble (£9.4m) were the top two TV advertisers in March. Meanwhile, NHS England spent £3.9m on TV advertising, while the supermarkets Asda, Aldi and Tesco spent £3.7m, £3m and £2.1m respectively.

Barney Farmer, UK Commercial Director at Nielsen said: “March was the turning point in the UK, as the country initiated the lockdown to combat the spread of the COVID-19 pandemic. This impacted the level of advertising spend across traditional channels. Cinema obviously took a huge hit, while TV fared relatively well in the first few weeks of March.

Looking ahead to the coming months, it’s clear these March results represent just the beginning of the shifts in spend we will continue to see. The question of which ad sectors will return and how much advertising spend will be injected back into the market will depend on many factors – the most important of which will be the Government’s guidance on what, when and how we can move about freely. The travel and tourism sectors, for example, which are typically big ad spenders will be waiting to see whether people can book or take summer holidays both at home and abroad. This will determine the marketing messages being run – or potentially lack of them.”

The data covers the time period from 01 March 2020 to 31 March 2020 and covers Cinema, Outdoor, Press, Radio and TV advertising spend.