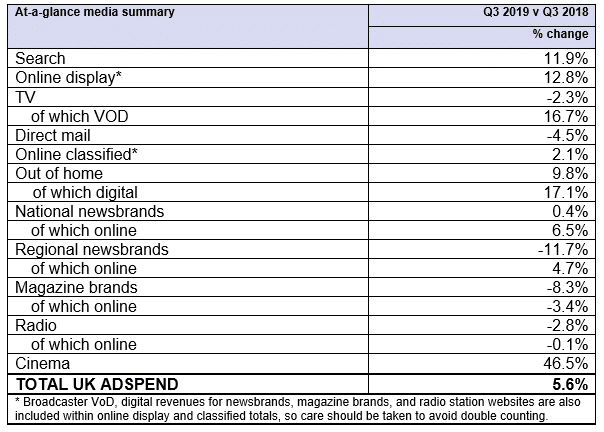

UK adspend rose 5.6% year-on-year to reach £5.97bn in Q3 2019, 0.8 percentage points ahead of forecast, according to new research Warc and the Ad Association.

The data indicates that online formats now account for three in five pounds spent on advertising in the UK, and contrast heavily with a contraction on growth in offline marketing formats.

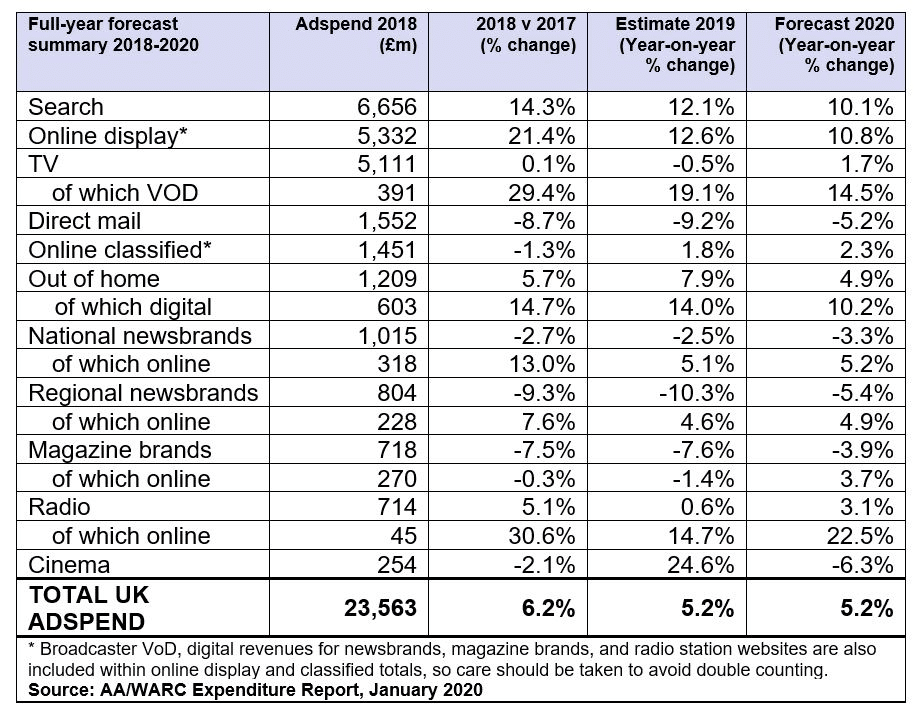

The figures mark the industry’s 25th consecutive quarter of market growth. Looking ahead to the full-year figures for 2019, UK adspend is now forecast to reach £24.8bn, meaning growth of 5.2%. This is expected to rise a further 5.2% in 2020 to reach £26.1bn.

Overall market growth is being driven by increased spend on online advertising, which saw percentage increases across every format.

This was led by digital out-of-home which rose by 17.1%, TV broadcaster VOD which saw a rise of 16.7% and national online newsbrands which saw growth of 6.5%.

The report also demonstrates strong growth in Q3 2019 compared to the same quarter in 2018 in cinema advertising, which saw a substantial rise of 46.5%.

Overall market growth is being driven by increased spend on online advertising, which saw percentage increases across most formats:

• digital out of home up 17.1%

• TV broadcaster VOD up 16.7%

• national online newsbrands up 6.5%

• regional online newsbrands up 4.7%

Only online magazine spending and online radio spending failed to show any growth during the quarter.

Woodford pointed to “exceptional growth in SME spend in digital, as well as larger advertisers continuing to move budgets into digital formats in most media sectors” adding that the projected growth for 2020 shows these trends continuing.

James McDonald, Data Editor at WARC injected a note of caution. “The UK’s ad market has sustained a 25-quarter period of expansion, but underlying data show that this growth is asymmetric,” he observed. “Excluding online advertising, the UK’s ad market has contracted each quarter for the last four years.”

In Q3 traditional media spending was flat or declining, although cinema spectacularly bucked that trend by growing 46.5%.

The tide is with digital however. “Online formats account for three in five pounds spent on advertising in the UK, and we expect this to rise to two in three by mid-2021, fuelling total market growth in tow,” said McDonald.

Total spending in 2020 is predicted to rise a further 5.2% to reach £26.1bn, with Woodford stressing the bigger picture. “With Brexit now a certainty, industry’s focus now turns to the future relationship with the EU and the importance of this to the overall health of the economy, which underpins this media spend growth,” he said.

Industry comment

Jonathan Barnard, Zenith, Head of Forecasting, Director of Global Intelligence, said: “5.6% adspend growth in a period of economic and political uncertainty is impressive, and well ahead of most of the rest of Western Europe. 2020 could be even stronger, now that we have a majority government and a resolution to Brexit, which will make it easier for advertisers to plan for the future. We still face uncertainty over our relationship with the EU when the transition period finishes at the end of the year, when restrictions on trade and investment will truly begin to weigh on the economy, so the longer-term prospects for the UK ad market may be less bright.

“The rapid growth of online advertising highlights the UK’s status as the world’s most digital ad market, which means that UK advertisers have the greatest opportunities to target the right audiences with the most relevant messages. But they also face the toughest challenge in knitting together disparate online audiences to create broad awareness, which requires investment in data and technology to do effectively and efficiently.”

Jem Lloyd-Williams, CEO at Mindshare UK, said: “We are encouraged to see adspend grow again this quarter. Despite months of uncertainty around Brexit and relatively weak UK economic performance, many advertisers have continued to invest for growth. Performance digital continues to take an increasing share but digital OOH, digital newsbrands and broadcast VoD look set to do well in 2020 too. With ever more sophisticated ways to reach precisely targeted groups in those channels, we can expect to see advertisers reap the benefits and accelerate their growth in 2020 and beyond. By putting audience at the heart of every investment we make for them, we are helping clients take full advantage of more integrated media strategies.

David Fletcher, chief data officer at Wavemaker UK, said: “Momentum in the advertising economy has continued its upward trajectory in Q3 according to the latest AA/WARC report. What is interesting is the dramatic rise of SME adoption of advertising as an engine of growth. This is not only clear proof of the vibrancy of the advertising industry but also an indication of the broader health of ‘UK Ltd’. A similarity between SMEs and the larger scale ‘digital endemic’ businesses (those whose consumer interface exists exclusively online) is the inherent digital bias of their investments. As these businesses expand and mature, so does their profile in expenditure towards a more plural mix.

“Advertisers should welcome the revenue shifts in traditional channels towards their digital counterparts (most obviously TV to VOD and digital OOH). These will fuel further investment in the consumer experience as well as more addressability at scale. The latest phase of BARB’s Project Dovetail provides another layer of actionable data drawing attention to the availability of audience to VOD. However, a word of caution: advertisers should be wary of too literally translating macro trends into direct behaviour shifts. These numbers show as much about the changing shape of our economy as they do advertising per se. And we know from our own Wavemaker analysis that there can be very significant category differences that are far from – and cannot be compared to – the ‘average’.”

Sam Taverner, EVP Marketing Solutions, Merkle EMEA: “Given the uncertainty around Brexit and the future state of our economy, it’s reassuring to see strong signs of growth within the advertising industry. What’s more reassuring, perhaps, is the continued popularity of digital formats, which is clearly driving overall market growth. Importantly, the results reaffirm a shift towards data-driven communications, which is crucial for any effective digital ad campaign. But whilst data is key to achieving tailored, people-based messaging, marketers must remember that long-term value will hinge on also adopting a cross channel approach. This will mean leveraging customer data across all touchpoints, allowing for a connected and seamless customer experience.”

Ali MacCallum, CEO, Kinetic UK, said: “Once again the report highlights a continuing growth in OOH spend. The investment by both the specialist agencies and media owners into dynamic creative capabilities, smart and useful data insights and automated trading platforms is resulting in more advertisers directing budgets to the channel. At the same time there is a better understanding of OOH’s ability to deliver both long-term brand awareness and short term sales activation. Whereas the last decade was shaped by an obsession with hyper-personalisation and digital marketing ‘in private’, increasing numbers of brands are recognising the need to build trust and reputation at scale and in public. This is a key factor behind the growth in digital OOH spend. With a growing emphasis on the ability of OOH to connect the physical and digital worlds and be there at the most valuable moments of commerce (particularly via mobile), we forecast that the channel will continue to benefit from a change in marketing behaviours. And the innovation within the medium means it will continue to grow well beyond 2020 – it will invest in more site infrastructure, use and leverage data more effectively, and further boost routes to reach audiences in the best context and location. What’s more, with wider understanding of how OOH can be integrated with other platforms such as social media and audio, the outlook for 2020 and beyond looks very positive indeed.”

Claire Burgess, Head of Biddable at NMPi, said: “The UK advertising industry continues to prosper, with the Advertising Association announcing an astonishing 25th consecutive quarter of growth. Yet look closely at the data and it clearly shows that this is a story of two-halves – all growth is driven by increased spend on online advertising, with online formats now accounting for every three in five pounds spent. With that expected to rise to every two in three pounds by mid next year it seems that digital advertising is in rude health – but we must not be complacent.

“With the likes of GDPR taking effect, and with Google joining Apple and Mozilla in phasing out the third-party cookie, the digital advertising ecosystem is changing beyond recognition. GDPR, CCPA, the ICO’s ongoing probe into real-time bidding and browser changes all continue to disrupt the foundations that most digital advertising is built on – so advertisers and publishers alike must look ahead to a cookie-less world. Privacy will become paramount and the value of quality, first-party data will rise exponentially. Of course continued industry growth (particularly in the light of clarification around Brexit) is something to celebrate, but as an industry we must look beyond the next few quarters to deliver something that benefits everyone in the ecosystem: advertiser, media owner and, ultimately, the consumer.”

Ben Little, Co-founder, Fearlessly Frank, ,said: “While the AA/WARC expenditure report shows digital to be healthy, it has been four years of steady decline for ‘traditional’ advertising media. Four years of UK advertisers dancing on the graves of generations of silver-tongued MadMen. The rush to digital revealed huge dissatisfaction with what ‘traditional’ advertising offered. Here, at last, seemed to be a medium that offered accountability. The idea of targeting specific groups through obscure algorithms was too much to resist. It promised to close the bean counter’s loop of money in, money out. But such Micawberish simplicity misses the point.

“If a non-customer doesn’t see your brand, therefore has no opinion about your brand, then they confer no value on those who use your brand. So users of your brand – the premium of which is in very large part down to that conferred value by non-users – feel a bit deflated. In a digital world, fame still has to be built. Savvy advertisers are beginning to realise that magic targeting algorithms aren’t so magic after all.”