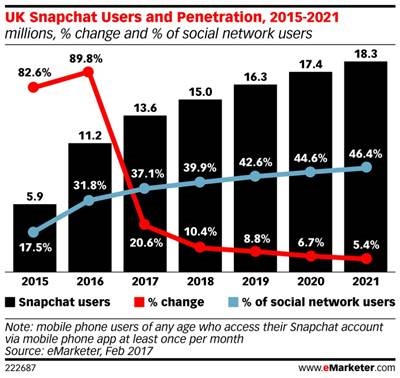

Snapchat’s UK user base experienced explosive growth of 89.8% in 2016, to 11.2 million users, according to eMarketer’s latest mobile usage forecast.

Strong growth will continue, and this year, snapchat will be used by 13.6 million people, representing 31.8% of all UK smartphone users.

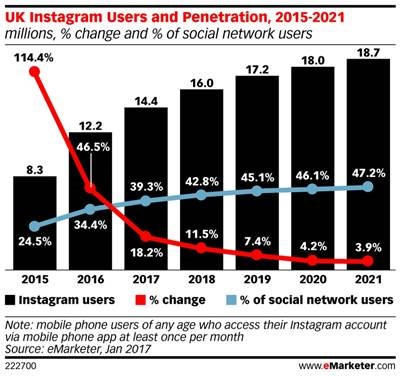

Instagram is a little further along its path to maturity, with its banner year of growth occurring in 2015 when its user base increased by 114.4%. Last year, there were 12.2 million UK users of the platform, and in 2017, that total will reach 14.4 million and 33.7% of all smartphone users.

By 2021, snapchat and Instagram are expected to have user bases of 18.3 million and 18.7 million respectively.

Even with such growth, though, Snapchat and Instagram will not be able to catch up with Facebook, which will continue to dominate the mobile usage category in the UK. Facebook is expected to have 30.3 million mobile users this year – representing 92.8% of all Facebook users and 71.1% of smartphone users. By 2021, the end of the forecast period, half of the entire UK population will be using Facebook on a mobile phone.

Twitter, meanwhile, has been usurped by these newer platforms. This year, its mobile user base will be 12.1 million, representing a lower total than for both Instagram and Snapchat. eMarketer expects the gap to increase throughout the forecast period as growth in Twitter’s mobile user base slows down, and by 2021, there will be an estimated 12.6 million users.

“The huge growth in these newer social platforms reflects a fundamental change in consumer behaviors,” said eMarketer senior analyst Bill Fisher. “They are fun, visual and much more intimate than the more established broadcast-style networks. And these functions appeal, in particular, to those age groups that are most engaged with their smartphones—millennials and younger consumers.”

Within the smartphone category, Android will dominate in the UK with more than 57.2% of the market, followed by iOS which this year will have just over 34.2% of the market.

Methodology

eMarketer’s forecasts and estimates are based on an analysis of quantitative and qualitative data from research firms, government agencies, media firms and public companies, plus interviews with top executives at publishers, ad buyers and agencies. Data is weighted based on methodology and soundness. Each eMarketer forecast fits within the larger matrix of all its forecasts, with the same assumptions and general framework used to project figures in a wide variety of areas. Regular re-evaluation of available data means the forecasts reflect the latest business developments, technology trends and economic changes.

Source: https://www.emarketer.com/