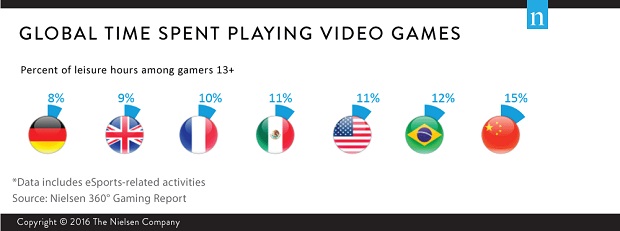

Gaming has firmly moved out of the basement and into the living room and beyond, taking up 10% of global user’s leisure times, according to new research.

The study, from Nielsen, found that more than half of the population in the world’s industrialized countries now identifies as gamers, which has brought a tidal wave of change across the way many of us spend our free time.

Today, gaming is as much an aspect of modern culture as anything else. In fact, as detailed in Nielsen’s 360° Gaming Report, gaming is a top entertainment activity for gamers around the world, taking up about 10% of their leisure time. But as is the case with other consumer behaviors, gaming preferences and trends vary around the globe, which means that marketers need individual strategies to engage them.

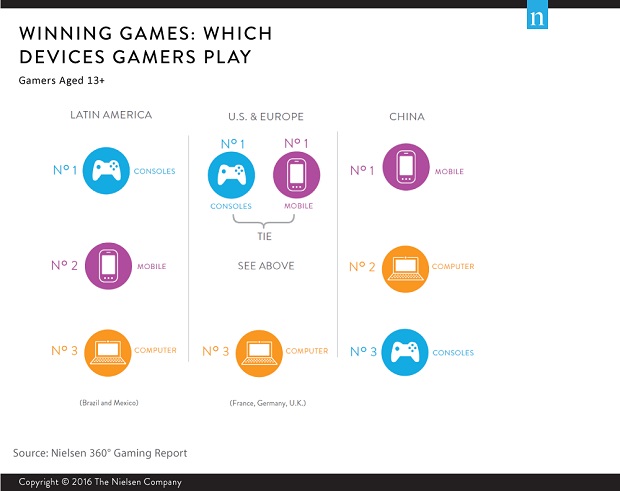

The ability to take gaming on the road and integrate it into our daily routines via powerful mobile devices has been significantly influential in bringing gaming into the mainstream over the past few years. In North American and Europe, console and mobile are tied as the most popular gaming platforms, whereas mobile dominates the Chinese market by a wide margin. Comparatively, console remains the top choice in Latin America. Understanding the penetration of each platform across regions is critical for any publisher developing and launching global games.

While the patterns of platform usage differ from market to market, the picture of the modern gamer is consistent globally. Not only have the gamer boys grown up, but they’ve enticed their friends and families to join as well. Today’s gaming generation is very inclusive, with tailored experiences across demographics.

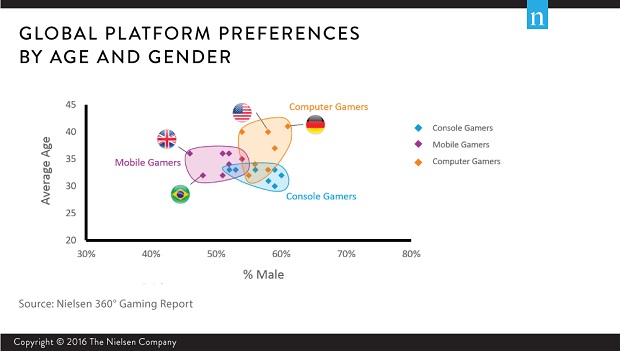

By now, gamers have become a balanced demographic across ages and genders. Mobile is the newest and most accessible platform to both men and women of all ages. However, there is a shift in traditional hardcore gaming as well, with Lara Croft’s evolution from a virtual (and very pointy) pin-up model to a smart, scrappy and very real role model, highlighting how gaming has clearly broadened its audience. That said, console gamers do tend to be a little younger, while PC gamers tend to be older. Both groups skew slightly male across all markets. While these big trends cross borders, there are market specificities that marketers need to be aware of. For example, gamers tend to be younger in Latin America, while the average age of gamers is highest in Germany.

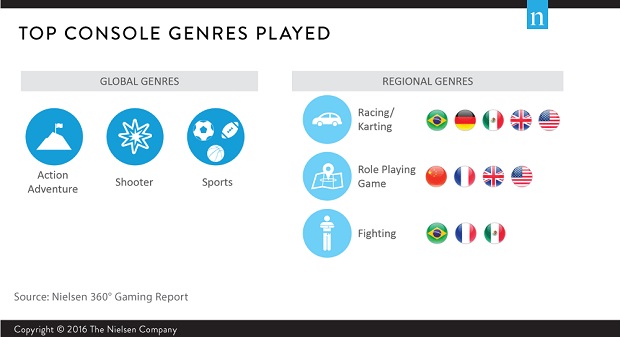

As with all art, however, some trends transcend sociocultural boundaries. For example, Nielsen found that when it comes to console games, action-adventure, shooters and sports are genres with universal appeal, driven by the highly successful blockbuster franchises in these genres. Regionally, specificities do emerge: Chinese gamers prefer role playing games (RPGs); fighting games are a successful category in Latin America; and racing games are strong performers in the Western world.

For mobile, puzzle and general entertainment are the most popular genres across markets, though again some regional differences exist. For example, casino/card/board games tend to be more popular outside of Latin America.

While there are similarities among the genres that gamers enjoy, different markets require different marketing strategies and approaches. Monetization is a good example. Specifically, gamers have very different preferences about how they want to spend their money. When given the choice, people will always opt for free games regardless of where they live. This isn’t too surprising from an overall perspective, but it’s worth noting that there are country-specific payment preferences. For example, in the mobile realm, gamers in China and the Latin America markets have the heaviest preference for freemium titles, while players in Germany have a strong preference for paid games.

Gaming is a global phenomenon, but marketers need to be sensitive to the specificities of each territory to make sure they fully connect with gamers.

Source: Nielsen