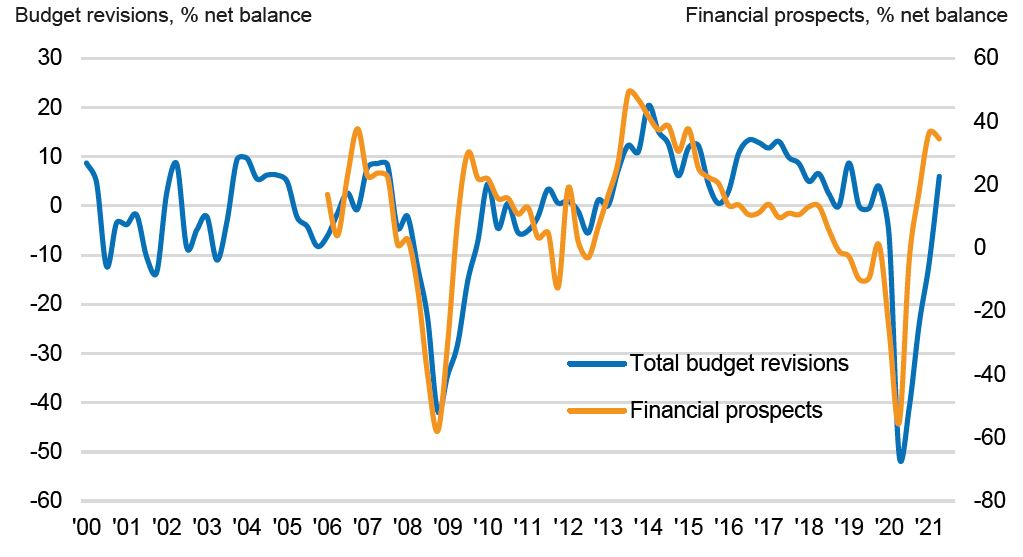

Total marketing budgets across the UK increased for the first time since Q4 2019, rising by a net balance of 6% across surveyed companies, according to new data.

The findings, from the latest IPA Bellwether report, signal a reversal from the -11.5% recorded last quarter, as well as the sharpest increase since the first quarter of 2019.

Optimism is also on the increase, with a net balance of 34.6% indicating a strong overall level of confidence, the second-highest recorded since 2015 (behind only last quarter’s figure of 36.6%).

Key findings

- Video continued its steady growth from last quarter, increasing by 4.2% (3.3% growth recorded in Q1).

- Audio budgets returned to growth, reversing a 9% decline from last quarter to a 1% increase.

- Declines still observed in the out-of-home (-7.5%) and market research (-9.6%), though these are substantially less dramatic than the cuts recorded last quarter (-24.1% and -17.8% respectively).

- Re-opening of the UK economy following the Covid vaccination rollout will drive overall recovery over 2021 (7.5%) and 2022 (6%), before tailing off in later years as the economy recoups its losses attributable to the pandemic

Financial prospects at company and industry level also remain firmly in positive territory and adspend forecasts are revised higher for 2021, as businesses began to prepare for a strong economic recovery.

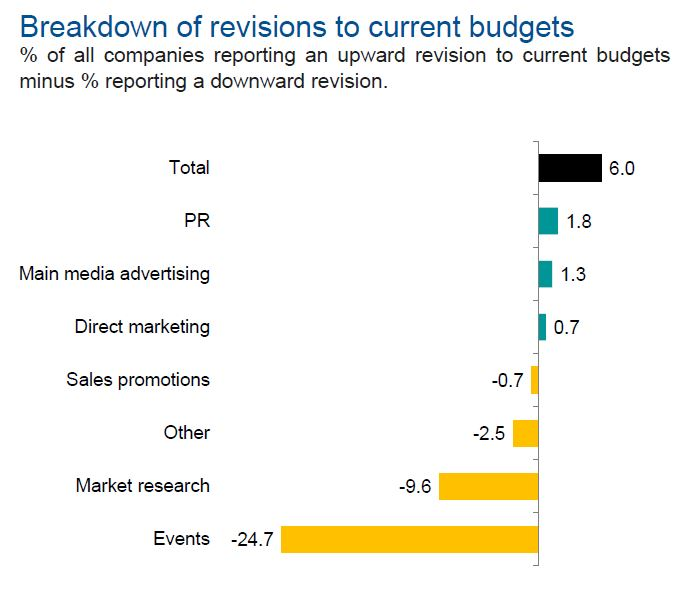

A net balance of +6.0% of surveyed companies expanded their total marketing budgets during the second quarter. Just over one-in-five (21.2%) panellists registered growth, compared to 15.2% that reported a decline. This was the first time since the fourth quarter of 2019 that total marketing expenditure had been revised up. Furthermore, it was the sharpest increase since the beginning of 2019 and a notable contrast to the net balance of -11.5% of firms last quarter that had recorded spending cuts. The latest results bring to an end a five-quarter sequence of continual cuts to overall marketing spend.

According to anecdotal evidence from the survey panel, strong vaccination uptake and the end of virus containment measures supported expectations of an economic recovery. Many firms are also anticipating strong sales as consumers unleash demand which has been pent-up over the course of the pandemic. That said, some erred on the side of caution and were uncertain of the impact of new strains of the virus. Others were also concerned that consumer behaviours may not return to what they were before the pandemic and were unsure on the best way to position their business in this event.

Revisions by media category

Three categories of marketing spend recorded upward revisions during Q2. Public relations led the upturn with a net balance of +1.8% of firms growing their expenditure in this space (up from -8.0% in Q1). The key segment of marketing, main media, also recorded growth in the second quarter.

A net balance of +1.3% of businesses raised their main media budgets (up from -8.2% previously). Within main media, video (+4.2%, from +3.3%), audio (+1.1%, from -9.0%) and other online advertising (+11.0%, from 0.0%) all grew, while published brands (-6.1%, from -22.2%) and out of home (-7.5%, from -24.1%) budgets were downwardly revised.

Elsewhere, latest data signalled a slight uptick in direct marketing budgets (+0.7%, from -11.8%), while sales promotions (-0.7%, from -16.2%), market research (-9.6%, from -17.8%) and other (-2.5%, from -14.7%) marketing expenditure were all cut. Given the continued restrictions on large gatherings that were in place during the second quarter, it was no surprise to see events budgets (-24.7%, from -43.2%) register by far the strongest decline of the monitored forms of marketing.

Firms remain strongly positive towards company and industry prospects

Latest survey data signalled further robust optimism among Bellwether panel members towards both their industry-wide and company-specific financial prospects, as was also the case in the opening quarter of 2021.

With +45.9% of panel members becoming more optimistic regarding their company’s financial prospects compared to three months ago, and only +11.4% signalling pessimism, the resulting net balance of +34.6% indicated a strong overall level of confidence. Although the net balance was slightly lower than in the first quarter (+36.6%), it was nonetheless the second-highest reading since the first quarter of 2015.

Similarly, financial prospects at the broader industry level remained firmly in positive territory during the second quarter of 2021. A net balance of +21.1% of surveyed companies were more bullish versus three months ago. Again, the level of optimism was robust overall and only bested by the reading in the first quarter (+26.2%), which was the strongest for six-and-a-half years.Adspend forecasts revised higher amid successful vaccination rollout

In light of the UK’s successful vaccination programme and phased re-opening of the economy, the Bellwether Report is now anticipating a much stronger expansion in GDP this year, followed by a robust rate of growth in 2022. Indeed, increased savings during the lockdowns are likely to fuel a brisk recovery in household spending once the COVID-19-related restrictions end, and the extended furlough scheme has delivered resilient labour market conditions.

Consequently, the Bellwether Report anticipates 2021 and 2022 to record strong rates of growth in adspend. It has pencilled in expansions of 7.5% and 6.0% respectively as businesses recover to their pre-pandemic levels of activity. Beyond the next 18 months, it foresees adspend growth moderating to 2.7% in 2023 once the UK economy has recouped the pandemic-related losses, and then adspend growth of 1.2% and 2.4% in 2024 and 2025 respectively.

That being said, there are a number of risks to these forecasts. New variants of COVID-19 could undermine the effectiveness of the vaccine, and job losses once the furlough scheme ends could impact consumer spending. There are also strong fiscal challenges on the horizon given the immense cost of economic support during the pandemic, which is likely to see tax burdens on businesses and households increase.

A V shaped recovery?

Commenting on the latest survey Paul Bainsfair, Director General, IPA, said: “These positive results mark the end of five quarters of continuous cuts. For revisions to UK marketing budgets to bounce back so quickly and strongly, following their nadir at the height of COVID-19 restrictions in Q2 2020, is very welcome news and corroborates our Bellwether prediction for a V-shaped recovery. As the vaccination rollout continues at pace and UK plc gears itself up for growth, we encourage companies to ramp up their advertising to make the most of post-lockdown, pent-up consumer demand.”

Joe Hayes, Senior Economist at IHS Markit and author of the Bellwether Report, said: “The economic data that has emerged in recent weeks tell us that UK businesses have embarked on what we hope will be a short road to recovery. The Q2 2021 Bellwether report was no different, and the strongest upward revision to total marketing spend since the beginning of 2019 is a great indication that firms have grown confident towards economic prospects. We hope that this is just the beginning and the end of lockdown restrictions, further improvements in vaccination rates and buoyant consumer spending will support even stronger growth in marketing spend in the second half of the year.”

David Shearer, Managing Partner, MediaCom Edinburgh and IPA Chair for Scotland, said: “As the so-called ‘Freedom Day’ (well, not quite yet outside England!) fast approaches with its attendant loosening of restrictions, it is hugely encouraging to see UK businesses getting ready for a strong economic recovery in the second half of 2021. Understandably, there are lingering concerns over the potential impact of the recent upsurge in coronavirus cases and new strains but broadly confidence is steadily improving due to rising vaccination rates and anticipation of a full re-opening of the UK economy. This is being reflected in forecasted advertising expenditure levels and I’m certainly hopeful that the predicted pent-up consumer demand will continue this road to recovery.”

Valerie Ludlow, CEO, ASG & Partners and IPA Chair for Northern Ireland, said: “After over 16 months of learning to live and work in a pandemic, I am delighted to see that the Q2 2021 Bellwether Report shows real signs of positivity and confidence in our economic future. There’s no doubt that there are still concerns within the business community, but the building momentum of the recovery is outweighing them for the first time in many months. We must always remember that what we have experienced over the last year has not been a ‘market failure’, it has been driven by a most dreadful pandemic.”

Michelle Wright, Managing Director, Gough Bailey Wright and IPA Chair for England & Wales, said: “After eighteen months of uncertainty there is finally something to be optimistic about. It’s truly refreshing to see real evidence of growing confidence in businesses as they prepare for a strong economic recovery and invest into their marketing programmes.

“With over half of the UK population fully vaccinated and further relaxing of lockdown restrictions, brands are clearly looking to increase market share and strengthen communications with their customers, this is evident in the report with PR enjoying the highest upturn of expenditure during Q2, since Q4 2019.

“There is understandably some caution around new strains of the virus and customer behaviour, but if the situation continues to improve, these forecasts suggest we can look forward to a more stable and brighter future.”

Amy Lawrence, Digital Director, MediaCom & Chair of the IPA Digital Marketing Group, said: “After such a difficult 2020, it is fantastic to see the optimism in this Bellwether Report. It is no surprise that this is reflected especially in digital budgets, as the industry continues to recognise the shift towards ecommerce, and focuses on performance goals. Although there are reasons to be cautious as we leave behind many of the pandemic restrictions, increased consumer spending means we should be confident that this trend will continue.”

David Fletcher, Chief Data Officer, Wavemaker UK, said: “Pretty much every business has worked out that the future will still have an office – a consistent gathering point and source of common interest and identity – but that there are other ways of doing these things. Some of these are quite good to have in the mix so sure, let’s have an office but maybe make it a bit smaller? The latest Bellwether data suggests that the Market Research sector is suffering the same dynamics – still needed for marketing but not the only way of doing things now that the pandemic has taught us other routes to blend in for insight and effectiveness.”

Industry comment

Alexander Goesswein, VP Key Accounts, EMEA at Criteo, said: “After a unpredictable year in advertising, it’s encouraging to see optimism return and marketing budgets jump sharply up for the first time since the end of 2019; unsurprisingly online advertising grew by 11%. While the pandemic forced marketers into a cautious approach, it also advocated for an online-first mentality and a greater reliance on digital that allows brands to find creative ways to reach their audiences.

“Today, the world is edging back to ‘normality’ and in the UK the confirmation this week of most restrictions easing by July 19th would have served as a well-timed boost for all aspects of marketing budgets. But, consumers aren’t going back to their old shopping habits overnight and the challenge for brands moving forward is to devise an online strategy that compliments offline channels. It’s more important than ever to satisfy customers at every touchpoint and achieve a balanced experience. This can be achieved through connecting with consumers by targeting them at all touchpoints; allowing them to discover, evaluate, engage and ultimately buy into a product or service. Where agility was required first and foremost – 9 in 10 marketers across all verticals stated they had made changes to their strategy due to the pandemic – we are now seeing stability return to the industry.”

“Going into the second half of the year, brands will have to find a way to stand out in a saturated online marketplace and hit that sweet spot where offline and online converge, for one channel cannot thrive without the other. And as we see the beginnings of an economic rebound materialise, the move into a post-cookie era, where targeted advertising will have to be more granular and accurate to consumers’ ever-changing habits, it will ultimately shape brand ROI, or reputational challenges.”

Elizabeth Brennan, Head of Advertiser Strategy at Permutive, said: “The latest IPA Bellwether report paints a positive picture of the recovery of the industry. It is extremely encouraging to see marketing budgets thriving again for the first time since 2019, with ad spend forecasts also set to improve throughout 2021.

“With the recent updates to Apple’s privacy protections for iOS 15, coupled with third-party cookies being removed from Google Chrome by the end of 2023, it’s clear the protection of consumer privacy in digital advertising is gaining momentum. As we enter this new post-pandemic era, consumer privacy must remain at the forefront of advertiser’s minds. Both advertisers and publishers must ensure they have a sustainable, privacy-safe solution that not only safeguards them from the tumultuous changes in the industry, but helps them take advantage of upcoming opportunities. For this to happen, adtech will need to take a new role in facilitating the direct relationships between media buyer and media owner. Publisher first party data is already becoming the key to the future of digital advertising.”

Silke Zetzsche, Commercial Director, A Million Ads, said: “It is fantastic to see marketing budgets improving for the first time since Q4 2019 – a true sign of the progress and recovery our industry is making. However, brands shouldn’t get complacent – now is the time to bring a fresh take to advertising to recapture the attention of consumers through a personal approach.

“The report shows that within main media, video spend has increased by 0.9% from Q1, whilst audio spend has increased by a massive 10.1%. This should come as no surprise and as a result, we are increasingly seeing advertisers rolling their audio and video advertising approaches into one to create a unified AV strategy. Adding a dynamic element to this allows brands to instantly adjust elements such as voice-overs, script lines and visuals based on contextual clues and data signals, making the creative much more engaging and personalised to its target audience.

“Research we recently conducted has also shown that 55% of UK consumers are more likely to buy a product if an ad they have seen or heard is personalised. Therefore by adopting a unified dynamic AV strategy, brands are able to personalise audio and visual elements, making advertising an experience consumers can enjoy.”

Justin Taylor, UK MD at Teads comments, said: “As restrictions in England start to ease, it’s fantastic to see that confidence is returning with UK marketing budgets increasing to what we were seeing pre-pandemic. However, the industry can’t rest on its laurels and learnings from the pandemic should be carried forward for years to come. The principles of investing in premium publishers and taking a sensible approach to keyword blocking must remain. What’s more, brand safety and working with partners that respect the user experience will be key if we are to meet the strong rates of growth in ad spend in 2022 which are forecast.

“As the latest IPA Bellwether report signals, brands expecting strong sales must remain on the edge of caution due to new strains of the virus. With online advertising up +11% from the previous quarter, it will be important for brands to continue to invest in quality digital partners to ensure they are communicating with consumers in a positive way if they are to see conversion rates come to fruition.”

Shumel Lais, Founder and CEO, Appsumer, said: “It’s welcoming to see ad spend and confidence growing in line with vaccine coverage. However, what’s clear is that budget isn’t coming back in all the same areas as before as consumer behaviour has accelerated towards online and mobile app purchases. Our research, for instance, has shown that lockdown caused budget growth across many app categories like fitness, gaming and food delivery. This consumer behaviour has become embedded faster than anticipated and simultaneously, brands are having to adapt their models and their advertising strategies to reflect this. Consumer habits will not return to pre-Covid normality and as a result, the advertising mix will not either.

In addition, mobile app advertisers are also having to contend with iOS 14.5+ adoption that has reached critical mass in recent weeks. In fact, we’ve seen advertisers increasingly shift budgets from iOS to Android and this has been most notable amongst smaller brands. Moving forward, mobile app advertisers, no matter the size, should be looking to further diversify their media mix to limit exposure to market volatility. And only by getting the right measurement tools in place will they reap the rewards.”

Ben Walmsley, Commercial Director, Publishing, News UK, said: “It is heartening to see marketing budgets increasing for the first time since 2019. Throughout the turbulence of the pandemic some advertisers cut budgets and focused on performance, whilst others took a bolder approach by striving to emotionally connect with audiences, either to show empathy or how their brand could offer practical help. As the post-pandemic world takes shape, advertisers should take note of the positive impact of stronger emotional connections successfully forged over the last year when creating campaigns.

“Our research has shown that emotional context can increase advertising attention by up to 45% by understanding the emotional resonance of the content around which it sits. It is therefore not surprising that the power of emotion as a targeting mechanism is becoming ever-more important for advertisers. Critical to success will be the ability for marketers to understand the extent to which preferences, opinions and emotions have changed and the permanence of those changes.

“To support this News UK recently launched Nucleus, a first party data platform that offers unique insight on how audiences are consuming media and their changing lifestyle attitudes. In a rapidly evolving market, access to deep audience understanding will be essential to brands to communicate effectively in a privacy-first world that is profoundly different to that of March 2020.”

Charlie Smith, Managing Director, Europe, Blis, said: “As restrictions start to ease in the UK, it’s positive to see that marketing budgets have increased for the first time since Q4 2019. This signals a boost of confidence following the pandemic and is a sign that we are heading to recovery, as vaccinations continue to roll out and we slowly return to normality. Indeed our own data highlighted that as of the end of May the number of visitors to high street retailers in the UK was 95% of our pre-COVID benchmark.

“However, the industry is still in a period of uncertainty when it comes to addressing privacy and identity. With Google’s recent announcement that it will delay the deprecation of third-party cookies for a further two years many marketers have been left in limbo. But let’s not forget, most third-party data in the programmatic ecosystem is not fit for purpose. Therefore, as brands begin to replenish their budgets they need to ensure they are investing in new privacy-first solutions that put the consumer first.

“Now is the time for the industry to move away from its previous reliance on personal data, by choosing a new way forward. For example, there are still a wide range of data signals available to draw upon, which, when utilised in combination with location intelligence, allows marketers to map precise audiences for targeting. Ultimately, marketers will benefit from a more innovative and informed approach to digital advertising and the industry should embrace the chance to rewrite the rulebook for a privacy-first world that works better for brands and consumers alike.”

Dominic Woolfe, CEO, Azerion UK, said: “The IPA Bellwether report reflects the optimism we have felt over the last few months with the lockdown restrictions slowly but surely lifting. The socio-economic impact of this quarter has been promising, as businesses begin to prepare for a strong economic recovery following the impacts of Covid-19. In light of the successful vaccination programme throughout the UK and the re-opening of the economy, it is great to see that the UK is now gearing itself back up for growth with the increase in marketing budgets and ad spend this quarter a strong indication of this.

“However, if the industry is to meet the forecasts predicted for ad spend in 2022 brands must continue to work with partners that deliver meaningful outcomes. With the IPA Bellwether report playing on the edge of caution regarding new strains of the virus and how this may result in a brisk spell of consumer spending, brands will need to maintain a consistent level of communication with consumers in a creative and engaging way within brand safe environments.”

Jonny Whitehead, Board Director, Skyrise Intelligence, said: “It’s great to see marketing budgets have expanded for the first time since 2019 with places opening up again and with businesses expected to make a strong economic recovery. This shows that confidence is definitely regaining post-pandemic and the industry is moving in the right direction.

“While progress is certainly being made, agencies and advertisers will need to balance new ways of working with the need to adapt to a rapidly changing digital landscape. There will also be a need to focus on accessing, analysing and testing the use of non-personal targeting signals such as context, time, and location as the industry prepares for further data deprecation if we are to meet the strong growth forecast for ad spend in 2022.”

Nial Ferguson, Managing Director UK & Ireland, Sourcepoint, said: “This latest IPA Bellwether report points towards 2021 as a year of strong growth for the advertising ecosystem, as we reach pre-pandemic levels of spend. While Covid-19 has caused disruption to many marketers, issues such as increasing global privacy regulations and restrictions on browser identifiers still remain an important issue for those who don’t seek resolutions. Therefore, businesses must harness the increase in marketing budgets to future- proof themselves against changing regulations and privacy enhancements.

“Going forward, the industry must place data ethics front and centre to communicate the value exchange to consumers. We now have the opportunity to invest in compliant technologies that support the free and open internet, which can, in turn, create a privacy-first future.”

Barry Cupples, CEO of Talon Group, said: “We’re seeing a really positive return to market from brands across the summer as the UK opens up and over 45m adults receive their vaccination. Out of Home – and particularly digital OOH – are projected to outgrow the ad market not just in 2021 but to continue the evolution in 2022, with forecasts expecting its value to increase by 57% in the UK this year.

“Consumer sentiment and confidence for a return to the entertainment, retail and travel sectors gives huge opportunities for brands and the OOH channel. This reflects the incredible resilience, collaboration and agility shown by OOH over the pandemic. We are now brilliantly placed to deliver technology and data advances for integrated media targeting alongside online advertising and we are generating outcome-led campaigns, creativity and truly reaching audiences as they re-emerge from lockdown. A key factor for us in OOH is the ability and flexibility to deliver effective outcomes alongside TV and social media channels for brands hungry to reconnect with consumers coming out of the pandemic. Our core strengths of reach, engaging young audiences and delivering effective outcomes will pay dividends for the rest of the year, as reflected by the IPA analysis, with brand activity delivering more integrated campaigns across online and offline channels.

“If we’ve learned anything from our COVID experience, it is that understanding audiences by their location and mindset is paramount for brands to connect effectively. Digital OOH is back in positive growth with a real ability and benefit to use context to appeal to the new consumer. Powerful branding and activation messages can be made in the public space, supported by data and digital OOH’s fundamentals to ensure brands can easily deliver relevance to any audience.”

Sally Laycock, CEO at Incubeta UK, said: “It’s fantastic to see marketing budgets are at their highest since Q4 2019 and signals a promising H2 for the industry. As the UK continues to lift restrictions, sectors that had been affected by the pandemic are slowly bouncing back. In store purchases are increasing as the highstreet opens and travel is slowly beginning to open as consumer confidence returns thanks to the vaccine rollout.

“With marketing budgets increasing, it will be important for marketers to continue embracing the digital innovation they’ve invested in during the pandemic. While life is returning to normal, investment in digital should not be discarded and instead it should continue to work in unison with offline channels.

“As the excitement around Freedom Day continues to build, consumers will be out and about, largely returning to their pre-covid habits which means there will be a diverse range of opportunities to reach consumers. To have the best chance of keeping track of a newly mobile audience, marketers will need to develop a unified approach to campaigns and utilise their data-driven capabilities to engage, interact and connect across multiple channels and devices.”

Tim Geenen, Managing Director, Addressability Europe at LiveRamp, said: As substantiated by the report, we’ve been anticipating that advertising budgets would rebound and expand in 2021. Our own industry research suggests the same trend, revealing 78% of senior marketers believe that the final withdrawal of third-party cookies will have a positive impact on their advertising strategy. Advertisers aren’t backing down. If anything, they’re doubling down, underscoring the value of reaching and engaging with customers across channels. Yet challenges still exist. While Chrome has delayed the cookie, the world is still more cookieless today than it is cookie-based. Safari, Firefox, mobile in-app, and CTV all operate without cookies. Marketers need omnichannel, neutral, people-based addressability and they want to buy on that today. We see case study after case study showing that people-based addressable buys outperform 3p cookie buys.

“Now is the time to encourage new, more direct ways for advertisers to reach and engage high-value audiences, and simultaneously explore direct first-party relationships to expand their data foundation and, ultimately, deliver better customer experiences.

Nicole Lonsdale, Chief Client Officer, Kinetic UK, said: “Audiences are out and about in record numbers, and the Q2 Bellwether report confirms that brands are ready for a resurgent economy. We are seeing a strong return to growth in OOH investment and anticipate that the lifting of restrictions on July 19 will create another surge in activity and in confidence. But the OOH sector is under no illusions that the world will be as it was in 2019 – consumers will want to get out and experience the world more than ever, but some behaviours and patterns of activity will be different for a while to come. Whether that’s how they shop, socialise or commute.

“The investment in digital technology, automation and data optimisation capability that took place during the last 18 months is now delivering richer near real-time insights into audience mobility and behaviour. And this is enabling us to provide brands with more targeted, flexible and creative approaches that maximise the impact of public media. This will prove hugely important.

Neil McKinnon, Marketing Director, Infectious Media, part of Kepler Group, said: “An overall increase in marketing budgets is a major milestone and within that the IPA’s report that digital media investment is to go from a flatline to an 11% up-tick, reflects what we’re seeing in the market. However, with more restricted budgets we saw big shifts to more accountable media spend and as was seen in previous recessions, we expect these changes to be permanent to a large extent. Going forward the digital media space will be all about intelligent growth.

Brands are now ready to invest with confidence and make strategic plans for how they do so, but the way they do so is also evolving fast. If advertisers are going to be able to react to rapid changes in consumer behaviour, they will need to continue to concentrate investment in more agile media channels, such as digital.

“A lot has changed over the last five quarters, not least of which is the transformation of business operations including in-housing talent and technology. Investment in first-party data and technology will be more important than ever, as the industry edges towards the slow death of the third-party cookie. To make sure advertisers are fit for this future, they need to continue to drive the transformation of their approach to media to be able to follow these changes.

Richard Kelly, Chief Revenue Officer, Mindshare UK, said: To see almost all main media returning to health much quicker than earlier estimates is fantastic news that will energise the incredible pace of innovation across the media space. We all know that society and consumer behaviour and media consumption changed during the pandemic because we lived it first-hand too. We can see this in the Bellwether data, with for example digital and video categories noted as strong performers.

“A return in confidence will stimulate both strategic thinking and creative experimentation to ensure brands are reaching people through emerging smart opportunities in TV, increasingly digitised OOH media, blended content and commerce and the increasingly diverse array of social, influencer, video, news and entertainment channels. As media investment returns to growth, understanding the dynamics of post pandemic audiences will be the key to brand success.”

Matt White, VP EMEA Quantcast, said: ” The Bellwether report findings reflect not only what we have seen gradually happening in Q1 2021 but also confirms our predictions for what is being termed an ‘advertising bomb’ coming in the second half of 2021. With large scale events being televised across the summer, this is going to be a great opportunity for marketers to spend the shelved budget from 2020 – as we’ve already started to see. Not only is this great news for brands that want to advertise at these events, it will have knock effects for publishers. Consumers will be looking for the latest scores, information and opinions and they’ll be heading online and visiting publisher websites more frequently. As a result, the demand for ad space could increase. Brands have a years’ budget to spend within six months, so it’s likely that they won’t hold back and will be placing as many ads as possible.”

Nick Reid, Regional VP of Northern Europe, DoubleVerify, said: “With this quarter’s Bellwether Report anticipating 2021 and 2022 will record strong rates of growth in ad spend – predicting 7.5% and and 6.0% respectively as businesses recover to pre-pandemic levels of activity – it is clear that the industry is aiming towards recovery. Brands, agencies and vendors must take this moment to reset and drive an improved ecosystem; one with clear baselines of media quality, accurate performance and relevant, privacy-friendly experiences. Only by utilising data more efficiently, and collaboratively, can they create a more transparent ecosystem which informs smarter strategies, fuels accountability and offers greater value for all stakeholders. After all, if we get this next phase right, and harness the current momentum of digital transformation, we can put in place profound benefits for all parties; striving for a stronger, safer and more secure ad ecosystem for the consumer and the brands who look to inspire them.”

Louise Ainsworth, Executive Managing Director, EMEA at Kantar’s Media division, said: “A recent boost in consumer spending and improving economic forecasts have lifted the moods of advertisers and marketers according to the latest IPA Bellwether report. As people head back to shops, restaurants and offices, businesses must carefully consider how and where they position themselves to make the most of rising confidence and capture spend from those with extra funds in their pockets after 18 months of restrictions. Understanding what makes people tick in a new and different world, as well as how the roles of traditional and digital media formats have changed during the pandemic is vital. Competition to secure a slice of post-lockdown spend will be fierce, meaning it’s more important than ever to ensure increased advertising budgets are highly targeted and that campaigns achieve real cut through.”