Facebook has seen a surge in usage since the coronavirus lockdowns, but the increases are concentrated on its private messaging and video calling, which it doesn’t monetize, and its ad business is suffering in countries hit hardest by COVID-19.

The social media giant has experienced a 50% increase in messaging traffic in certain countries, and video calls on Messenger and WhatsApp in these locations have more than doubled. Group calls in some of the hardest hit countries by the virus were up 1,000 percent last month.

In Italy, where more than 6,000 people have died from the coronavirus, there has been a 70% increase in time spent on Facebook-owned apps such as Instagram.

It might seem that Facebook is going to profit from the lockdowns, but the opposite is true. “We don’t monetize many of the services where we’re seeing increased engagement, and we’ve seen a weakening in our ads business in countries taking aggressive actions to reduce the spread of COVID-19,” wrote Alex Schultz, VP of Analytics, and Jay Parikh, VP of Engineering.

Facebook says the spike in usage has been more challenging than usual because of its employees working from home, but it’s working to keep its apps running smoothly. “We’re monitoring usage patterns carefully, making our systems more efficient, and adding capacity as required,” explained the company.

To help lighten the load, it is temporarily reducing bit rates for Facebook and Instagram videos in certain regions, something Amazon, Apple TV+, and Netflix have also done.

Yuval Ben-Itzhak, CEO at Socialbakers, said: “Socialbakers’ data reflects what we are hearing from brands. Because of uncertainty about the economic environment they are slowing down investment. This trend is expected to continue as businesses look for less costly alternatives to engage their audiences. That means that organic strategies driven by the right content may win during this period.

“Since we believe that now, more than ever, customers want to hear from the brands they follow, cutting back on social media investment could be a mistake on the part of the brands. Brand marketers need to be mindful that, faced with the prospect of social distancing and more time at home, their audiences will be looking to the digital world to keep them feeling connected, updated, and entertained.”

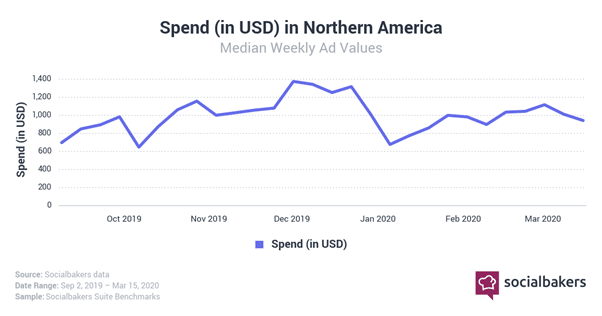

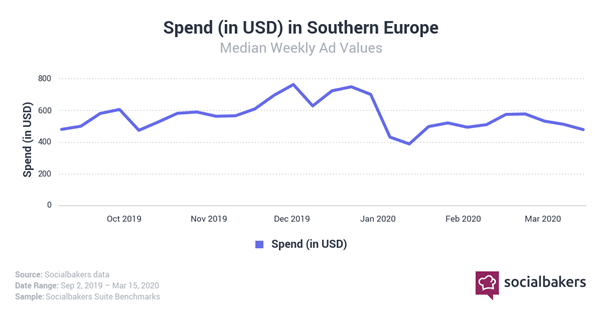

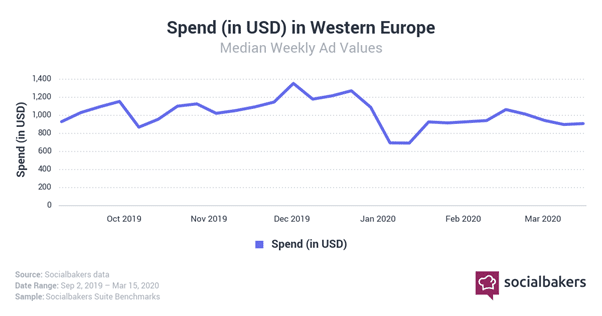

Ad spend in the US and Europe

US is the region where we have observed the steepest decline in ad spend since the start of March when the COVID-19 virus began to take centre stage in the country.

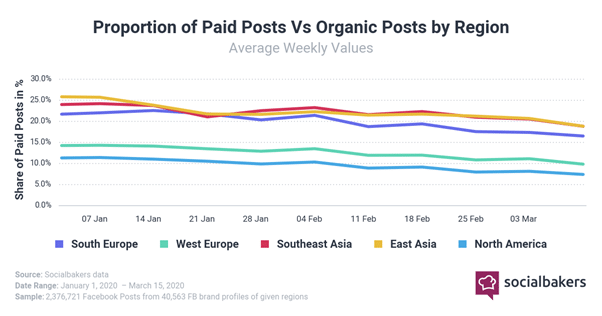

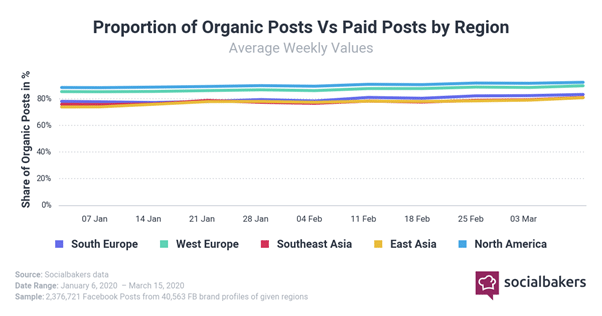

Proportion of paid posts by region

We see brands across all regions consistently posting less paid content.

Proportion of organic posts by region

Organic posts have remained strong, increasing ever so slightly across all regions since the start of the year.

Data source:

The data from Socialbakers is based on 2,376,721 Facebook posts from 40,563 brand profiles across multiple global regions from January 1 – March 15.