Esports viewing is on the rise, but Western countries still lag far behind China, where over 1 in 4 Internet users watched esports games in the last month.

Research from Ampere Analysis has found that 26% of Internet users in China watch esports at least once per month, creating a huge and highly engaged audience. Western markets lag China, but Denmark and Sweden lead European usage, with 8-9% of Internet users watching esports on at least a monthly basis. While esports’ largest demographic group globally is males aged 18-34, audiences are moving away from traditional stereotypes. In Q3 2019, 35% of those watching esports in the last month were female.

The rise of esports

China leads the world for esports viewers. 26% of Internet users in China said they watched esports services in the last month (based on Ampere Analysis’s consumer polling from Q3 2019). The League of Legends 2018 World Championship alone had a concurrent audience of 203m in China compared to just 2m in the rest of the world.

Nonetheless, audiences in Western countries are still substantial. Research by Ampere Analysis has discovered that between 5%- 9% of Internet users in developed Western markets typically watch esports on a monthly basis via online streaming services.

Denmark and Sweden lead esports viewing in Europe. 9% of Danish Internet users and 8% of Swedish Internet users watch esports on a monthly basis. Given the strong interest in esports in Scandinavia, it is perhaps no surprise that regional entertainment group Modern Times Group (MTG) has made numerous investments in the esports and gaming world. MTG currently controls several competitions and leagues, including ESL and DreamHack.

High profile tournaments have drawn in huge numbers globally. The 2019 Fortnite World Cup reached 20m global viewers on Twitch and the FIFA 19 eWorld Cup amassed 50m global viewers across platforms including YouTube.

Key demographics

The key demographic for esports is males aged 18-34, who are typically highly engaged with video content and are tech-savvy. These consumers are also less likely to view any content via broadcast TV channels and are 25% more likely to subscribe to at least one subscription video on demand (SVoD) platform.

While viewing is skewed towards younger male audiences, audience demographics are moving away from traditional stereotypes. 35% of viewers are female, 40% are over 35 and 33% live with young children.

In China, the gender mix is more balanced; 43% of esports viewers are female.

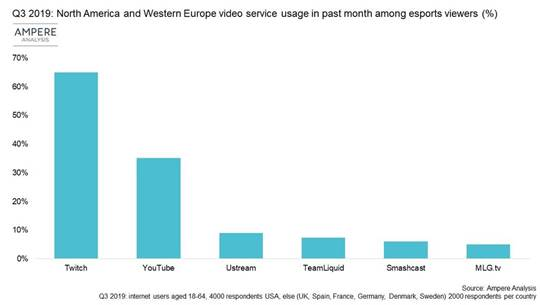

Twitch is way out in front

Amazon-owned Twitch is the principal platform for esports viewing, hosting a variety of channels through which fans can engage with their favourite games and gamers. Developers have also begun to explore hosting tournaments via their own platforms – relying on the popularity of their games to drive viewership; Tencent-owned Riot Games’ streaming service, Pro View, is specifically built for their League of Legends tournaments. Twitch, however, has a scale advantage and has struck exclusive third-party streaming rights for events including the Overwatch League through a deal with developer Blizzard.

Hazel Ford, Analyst at Ampere Analysis says: “The rise of esports viewing on a global scale presents a potentially lucrative opportunity for new and existing players. Platforms such as Twitch and YouTube are currently market leaders but face growing competition from a number of newcomers, including the developers themselves. As with the traditional sports world, exclusive rights deals will become crucial for platforms looking to control high growth esports audiences.”

Source: Ampere Analysis