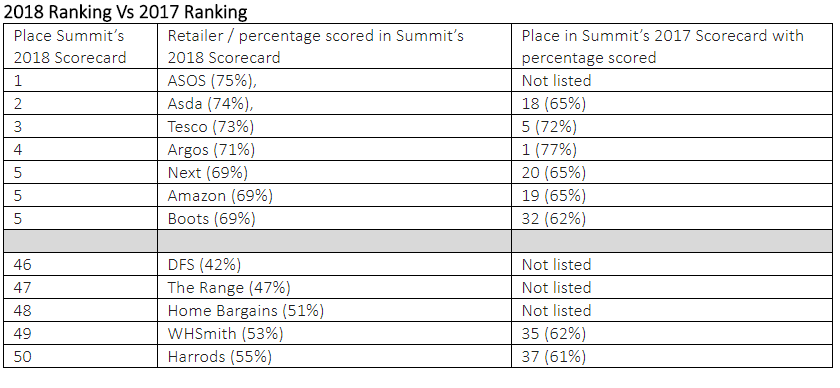

ASOS is the best performing online retailer when it comes to customer experience, while Harrods is at the bottom, according to new research looking at UK ecommerce usability trends.

The winners and losers of Summit’s 2018 Scorecard which ranks the online performance of the Retail Week ‘top 50 retailers by overall annual sales revenue’ has been announced.

Unsurprisingly, the top spots were taken by ASOS (75%), Asda (74%), Tesco (73%) and Argos (71%) with Next, Amazon and Boots all scoring 69% to take joint fifth place; at the bottom of the table was DFS (42%), The Range (47%), Home Bargains (51%), WHSmith (53%) and Harrods (55%).

The scorecard is compiled after assessing each retailer on 280 criteria across four business areas. These included ecommerce technology, which looked at the performance and usability of each retailers’ website; online marketing, including paid and natural search visibility and social media engagement; trading, including the quality of site content, product photography, pricing and payment options; and logistics and services, which looked at the quality of the ‘last mile’ experience and included a mystery shop to assess the effectiveness of their customer service.

Results showed that 56% of retailers saw a decline in their own brand searches and worryingly, 70% still don’t have adequate site speeds – a critical factor in lost sales opportunities; because the bounce rates increase to 32% when a site takes 3 seconds or more to load.

Images are a key conversion point that are being missed. While 50% of retailers feature less than four product images, half didn’t provide the information shoppers need to select the right sized products, with one in 10 not offering any form of size guide at all. A further 52% could not handle miss-spelled search terms, meaning customers didn’t receive the results they were expecting leading to poor online user experience.

Ben Latham, Director of Digital Strategy at Summit said: “Technology is evolving and customers are expecting more than ever before in terms of the online customer experience, but sadly our research shows that even among the largest retailers – who have invested heavily in their omnichannel capabilities – there are still improvements to be made.”

“This demonstrates the need for continued investment in digital transformation to stay ahead of the customer experience curve and ensure competitive advantage – and custom – aren’t given away. When investing in their omnichannel operations, retailers often put off certain improvements until they can be factored as part of a larger project, but this can be a mistake – for example, simply increasing the size of a product image can increase the conversion rate by 9%. Likewise, not using their website to cross and upsell means that the industry as a whole is missing out on £350m a year.”

“But perhaps one of the most surprising results came from our mystery shopping exercise – we simply hadn’t expected to be left with so many free products because retailers hadn’t factored in the cost of return, and found it more economical to provide refunds without collecting the products we were trying to return.”

To download the full report, go to www.summit.co.uk/scorecard