Ad blocking is a growing challenge for marketers in Germany – by the end of next year almost a quarter of the population will be using ad blocking software, according to eMarketer’s first-ever estimates of ad blocking in Germany.

An ad blocking user is someone who installs software on an internet-connected device specifically to prevent the advertising content of a webpage or application from being services and viewed, and using it at least once per month.

Once seen as the preserve of the tech-savvy, early adopters and gamers, ad blocking has now moved into the mainstream and by the end of 2018, eMarketer expects, 30.8% of internet users in Germany-equivalent to 20.3 million people-will be choosing to prevent digital ads from appearing on at least one of their devices.

Unsurprisingly, many ad blocking users hail from younger age groups, with the highest penetration in the 18-24 category currently having the highest rate of ad blockers; 52.1% of internet users in this cohort will block digital ads this year. The second most likely group to block digital advertising is the 25-to-34 age bracket, which has a penetration rate of 40.7%.

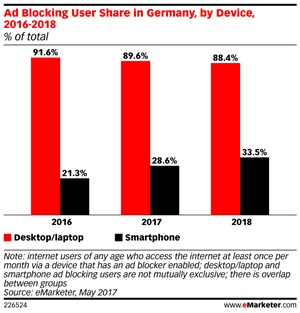

By regional standards, consumers in Germany were early adopters of ad blocking, with significant growth taking place in 2012 and 2013. In 2017, eMarketer estimates that of the 18.9 million people who will block ads, the majority (89.6%) will do so on a desktop or laptop PC. Meanwhile, 28.6% will block ads on smartphones. (There is overlap because some users block ads on multiple devices.)

As that smartphone figure suggests, ad blocking on mobile devices has yet to make a major impact in Germany;– this is largely because, as in the UK and the US until recently, mobile ad blockers are not as effective as they are on desktops/laptops. This is especially true within apps, where people are spending most of their mobile time.

“Consumers in Germany have always been relatively more concerned about potential breaches of privacy and security online than their counterparts in the UK, for example,” notes Karin von Abrams, eMarketer principal analyst. “A majority find digital ads intrusive and feel they deliver no benefit; in addition, many internet users dislike the fact that advertisers track their online behavior and may make commercial use of that data. On the other hand, internet users understand their favorite sites and apps typically need ad revenue to survive. So, they’re definitely prepared to compromise. For example, more than 80% of smartphone users polled by G+J e|MS last year said they found mobile ads acceptable if those ads weren’t superimposed on other content, and didn’t need to be closed separately.”

Methodology

eMarketer’s forecasts and estimates are based on an analysis of quantitative and qualitative data from research firms, government agencies, media firms and public companies, plus interviews with top executives at publishers, ad buyers and agencies. Data is weighted based on methodology and soundness. Each eMarketer forecast fits within the larger matrix of all its forecasts, with the same assumptions and general framework used to project figures in a wide variety of areas. Regular re-evaluation of available data means the forecasts reflect the latest business developments, technology trends and economic changes.