China’s urban middle class have moved from price to premium in the 2017 BrandZ Top 100 Most Valuable Chinese Brands.

Key findings:

• Tencent grows 29% to retain its position as China’s most valuable brand

• Technology, travel and education drive 6% growth in total brand value

• China moving from a production-based to a consumption-focused economy

BrandZ™ Top 100 Most Valuable Chinese Brands hit record levels in 2017, growing 6% to reach $557.1 billion in brand value. The WPP and Kantar Millward Brown study shows that technology, banks and telecom providers led category brand value contribution from the world’s second-largest economy. Technology player Tencent remains China’s most valuable brand, growing its brand value 29% to $106 billion.

As China pivots to a consumption-led economy, the most impressive performances have been posted by brands providing products and services for the urban middle classes. Education and travel agencies were the fastest-growing sectors, up 46%, although the much larger categories of technology and retail showed far higher increases in dollar terms, up 16% to $163.7 billion and 22% to $74.2 billion respectively.

The need to provide for the aspirations and growing sophistication of consumers in China has changed the competitive dynamic for many brands. Many have now reached the limits for penetration-led growth and are instead focusing on premiumization – the desire to access new, more distinct products and services – as a better way to attract wealthier, middle class consumers. The success of this strategy can be seen from Top 100 newcomer travel agency brand Caissa (no. 79), which has identified a niche market of travelers looking for a more refined experience.

Technology brands continued to lead the way, with Tencent strengthening its hold on the no. 1 spot thanks to the popularity of social media platform WeChat, while other sector players also performed strongly. Tencent was also one of three technology brands in the Top 20 Risers listing, reflecting the centrality of this category to Chinese life and their advanced adoption of consumer technology.

Alongside Tencent were Sina (no. 61) and NetEase (no. 31). Web portal Sina’s initiatives in live video and self-broadcasting through its Weibo platform helped to build its following among young people and attract advertising revenue, driving a 43% rise in brand value to $900 million. NetEase, a maker of online and mobile games, and a major e-mail service supplier, grew 36% to $2.6 billion. Digital technology now plays a part in every facet of daily life and newcomers to the listing such as e-commerce brand VIP.com (no. 40) and fast-risers like Sina and NetEase reflect this.

While they continue to be large contributors to the overall brand value, sectors that are still dependent on the traditional economy such as banks, insurance, and oil and gas categories have declined 6% in value. The exceptions are alcohol and food and dairy, where marketing activities by individual brands helped curtail the overall decline. Several brands of baijiu, China’s traditional rice wine, for example, expanded distribution and adjusted pricing and marketing to reach a broader audience. This allowed them to make up for a decline in sales after government measures to limit extravagance at official events reduced demand for alcohol, especially premium brands. Moutai increased 41% in value, entering the top 10 for the first time at no. 9.

“China has come to terms with a new normal for its economy but there are still massive opportunities for strong distinct brands to address the aspirations of the rising urban middle class and drive superior value for shareholders. The strong brand value growth we have seen this year in the technology, travel and education sectors demonstrate that brands that clearly meet a defined consumer need will thrive,” said David Roth, CEO EMEA and Asia, The Store, WPP.

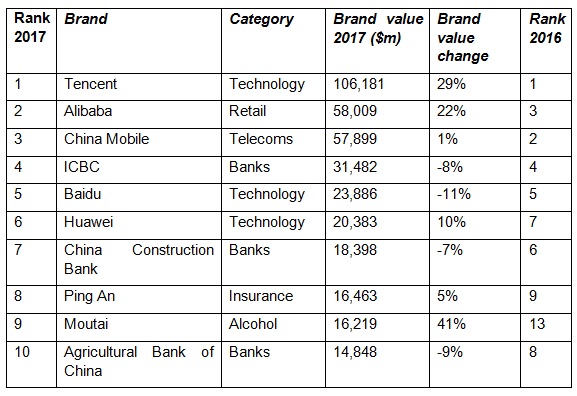

The BrandZ Top 10 Most Valuable Chinese Brands 2017

Chinese brands also continue to make strong inroads overseas. Impressively, many top technology brands now derive a significant proportion of their revenues from sales abroad. Lenovo was the most export-focused brand in the BrandZ China Top 100 with 72% of revenues gained from overseas revenue while Huawei secured 58% and ZTE 47% of their revenues from outside China.

The report also shows that the global perceptions of Chinese brands are changing and that this shift will continue as Chinese brands seek to boost overseas growth via organic expansion, acquisition and marketing activity outside of China. Overseas transactions conducted in 2016 by BrandZ Top 100 Most Valuable Chinese brands include Haier’s purchase of GE Appliances and the acquisition of UK online travel aggregator Skyscanner, by China’s travel e-commerce giant, Ctrip. Midea Group, the parent of appliance brand Midea, acquired two companies; Kuka, a German robotics company, and Japan’s Toshiba Appliances.

Some entrepreneurial Chinese brands are now looking for overseas success before returning their attention to their home market and examples include digital brands such as DJI, Anker, Elex and Ninebot.

“This year we have seen many firsts. With China emerging as a technology powerhouse, it is fitting that in Tencent we have the first brand from China to break the $100 billion brand value barrier. The Brand Power – which tests consumer inclination to select a given brand – of Chinese brands continues to grow and for the first time has started to surpass that of multinational rival brands. We expect this trend to accelerate in future years as Chinese companies realize they need to build differentiated brands to command a premium in a competitive market, where penetration led growth is plateauing off in many categories.” said Deepender Rana, CEO, Greater China at Kantar Insights.

Other key trends highlighted in this year’s report include:

• High-value brands continue to outperform the stock market and deliver superior shareholder returns. The BrandZ China Top 100 Portfolio, which includes all the Brands in the China BrandZ Top 100, far outperformed the MSCI China Index, improving 76% since July 2010, compared with a 6% rise for the MSCI China Index.

• Education brands Xueersi (no. 77) and New Oriental (no. 46) started from a low base, but led brand value growth, rising 58% and 43%, respectively. Both specialize in afterschool tutoring, test preparation, and English language learning, meeting both consumer needs and advancing national priorities by preparing Chinese adults and children for success in the domestic and global economies.

• Millennials now play an increasing role in commercial and brand success in China. Increasing millennial loyalty requires understanding of the distinct attributes they seek in brands. Consumers of all ages want products or services that offer quality, are trustworthy, and help make their lives better but Millennials are more likely to favour brands that are famous or trendy. BrandZ research reveals the most successful brand at increasing millennial loyalty was mobile phone handset brand OPPO, up 157% since 2014.

• Seven brands entered the BrandZ™ China Top 100 for the first time in 2017, with two returning. Newcomers were: retailer vip.com (no. 40); China CITIC Bank (no. 48); technology brand iQiyi (no. 50); men’s apparel brand Helian Home (no. 62); travel agency Caissa (no. 79); car brand Geely (no. 93); and Vatti (no. 99), a home appliance maker. The two returners were apparel brand Semir (no. 95) and the retailer Gome (no. 100).

“Chinese brands are taking the leap and going global on the back of three key factors; the country’s rising international stature, pressure to find alternative sources of growth as the domestic market slows and increasing overseas consumer receptivity to Chinese brands. Young consumers around the world are increasingly positive towards Chinese brands and we now see entrepreneurial Chinese brands starting overseas before they make waves in their home market,” said Doreen Wang, Global Head of BrandZ.

The full BrandZ™ Top 100 Most Valuable Chinese Brands 2017 report and ranking of the Top 100 can be downloaded here.