Mastercard has announced the European roll out of Identity Check Mobile, a new payment technology application that uses biometrics like fingerprints or facial recognition to verify a cardholder’s identity, simplifying online shopping.

The technology is now being introduced across 12 markets in Europe. These markets include the UK, Austria, Belgium, Czech Republic, Denmark, Finland, Germany, Hungary, the Netherlands, Norway, Spain, and Sweden, following a series of successful trials in the Netherlands, the U.S., and Canada.

The technology will be rolled out across the world in phases in 2017.

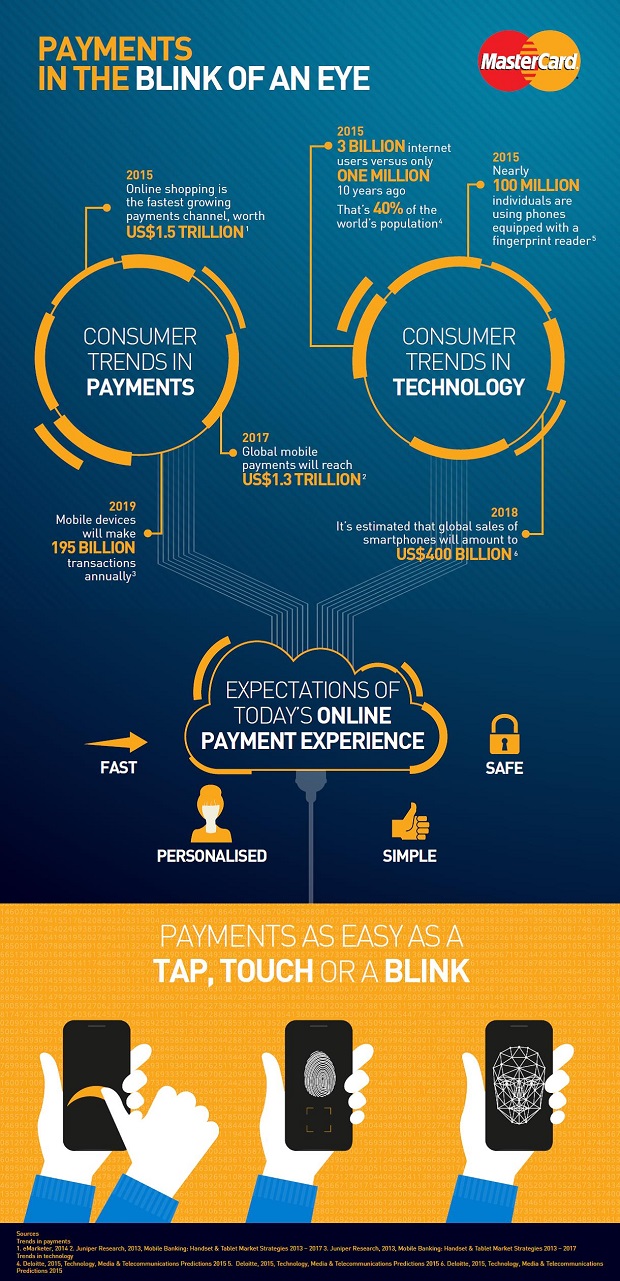

Typically, existing identity verification methods take shoppers away from a retailer’s website or mobile app where they are often required to remember and enter a password. The process can be time consuming and can result in a shopper abandoning their purchase or having the transaction declined if they enter their password incorrectly.

Mastercard Identity Check Mobile eliminates the need for cardholders to recall passwords, dramatically speeding up the digital checkout experience while also improving security. Instead, the cardholder can verify their identity by using the fingerprint scanner on their smartphone or via facial recognition technology by taking a “selfie” photo.

“We are relentlessly focused on making the online payment experience near frictionless, without making any compromises on safety and security,” said Ajay Bhalla, president of Enterprise Risk & Security, Mastercard. “This is a significant milestone in the evolution of payments. Shopping in person has been revolutionised thanks to advances like contactless cards, mobile payments and wearables, and now we are making Identity Check Mobile a reality for online shopping in Europe, and soon, the world.”

The move comes after trials and research discovered European consumers prefer biometric payments to current systems that rely on passwords.

MasterCard Identity Check Mobile app extends the company’s commitment to constantly improving online payment security.

Sebastian Reeve, Director Product Management, Nuance Communications, comments on the selfie pay technology:

“The global biometrics market is expected to grow to $44.2 billion by 2021, a massive increase from $7 billion in 2014, with many leading customer-facing companies – such as Barclays, First Direct, TalkTalk and HSBC – adopting the technology for authenticating sensitive information and speeding up the overall customer journey.

“While Mastercard customers may not yet be able to forget their password completely, we will increasingly see companies opting to leverage two biometric factors – for example, voice and facial. This will mean that if a consumer is outdoors at night or on a sunny day, and facial recognition is not going to be appropriate, the voice biometrics can kick in. Alternatively, in an environment where a consumer wishes to be audibly discreet, they can use facial recognition instead. This will ultimately speed up and secure the customer authentication process – helping us truly (and finally) bring around the death of the password.”