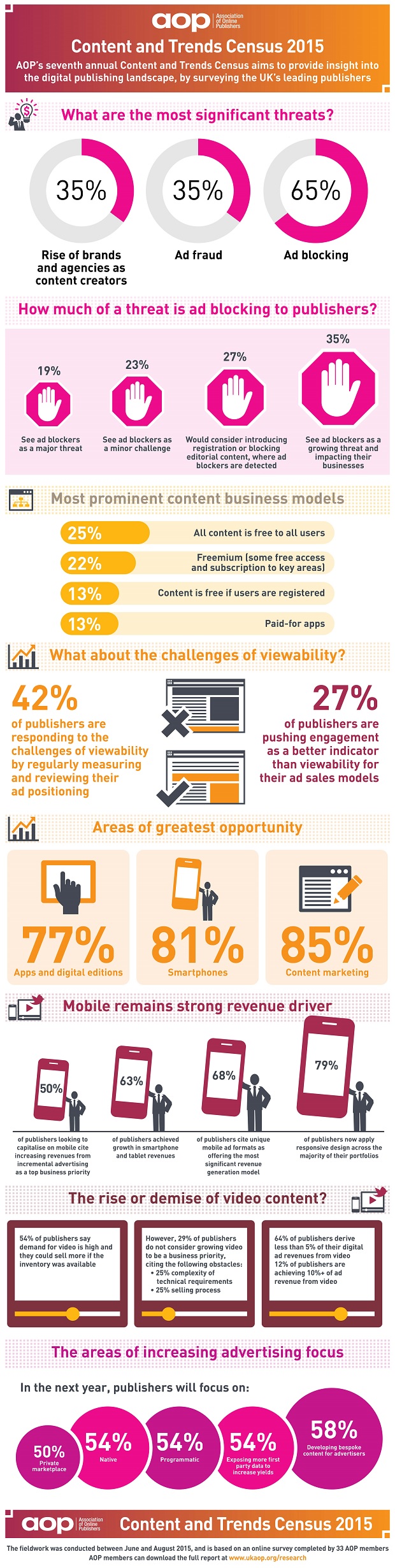

Ad blockers, ad fraud, and clients becoming content creators are seen as the biggest digital publishing industry challenges, accordingto a new report.

The latest findings from the AOP’s seventh annual Content and Trends Census reveal ad blocking is seen as a threat to the publishing business model (65%) – the first time the danger has appeared since the census began in 2006 – with one in five (19%) citing it as the most significant problem.

Other threats identified for the first time include ad fraud (35%) and the rise of brands and agencies as content creators (35%).

Key findings include:

· New industry challenges identified as ad blockers, ad fraud, and the rise of brands and agencies as content creators

· Publishers remain positive about opportunities within digital publishing

· 63% of publishers cite they have achieved growth in smartphone and tablet ad revenues over the last 12 months

Despite these challenges, the study reports publishers remain positive about opportunities within digital publishing. Over four-fifths (85%) of publishers view content marketing as an important area of investment. Mobile continues to attract positive sentiment, with 81% and 77% respectively considering smartphones and apps / digital editions as key prospects for growth.

Mobile advertising remains strong with 63% of publishers citing they have achieved growth in smartphone and tablet ad revenues over the last 12 months. Marking a significant industry development, responsive design is now the leading method of maximising site delivery on mobile devices, with 79% of publishers applying it across the majority of their portfolios. The top business priority for publishers looking to capitalise on mobile is increasing growth in revenues from incremental advertising (50%), with unique mobile ad formats cited as offering the most significant revenue generation model (68%), up from 53% in 2014.

Video continues to enjoy growth, with 12% of publishers achieving over 10% of digital ad revenues from the format. The study identified that demand is greater than existing inventory across desktop, mobile, and tablet – over half (54%) of publishers stated market demand is high, with the opportunity to sell increased volumes if available. Despite this confidence, 29% of publishers do not consider growing video to be a business priority, citing complexity of technical requirements (25%) and the selling process (25%) as obstacles, along with the reality that two thirds of publishers (64%) derive less than 5% of their digital ad revenues from video.

The study also reveals that increased integration with social media platforms provides a key vehicle to drive audience growth. Facebook and Twitter dominate as the most used social media channels for sharing and promoting content (both 97%), with over half (52%) of respondents looking to increase usage of Facebook compared to 14% for Twitter.

WhatsApp is a new social channel identified for 2015, a quarter (24%) of publishers currently use the app to promote content, with 17% claiming they will increase their use of the channel.

View an infographic summing up the findings below:

Tim Cain, Managing Director, AOP, commented: “The 2015 Content and Trends Census highlights an optimistic outlook within the digital publishing industry with opportunities for investment and growth. We need to work together to support premium publishers to combat identified threats, particularly ad blocking, given that the majority of publishers rely on ad revenue to provide free access to quality content.”

The findings of the report were revealed at the AOP’s Autumn Conference on 1st October 2015 and are available for AOP members to download for free at www.ukaop.org.

Source: www.ukaop.org