Uber has gained another $1bn in funding and been valued at close to $51bn, making the taxi app the world’s most valuable startup and reaching the mark faster than Facebook.

The growth reflects its aggressive global expansion into more than 300 cities and growing popularity ferrying millions of riders daily.

Investors in the latest round include Microsoft and the investment arm of Indian media conglomerate Bennett Coleman & Co., another person familiar with the matter said, as Uber seeks to bolster its technology and expand outside the US.

An Uber spokeswoman said the company had filed a document in Delaware in May to authorize the latest funding round.

Microsoft declined to comment. A Bennett Coleman executive didn’t immediately respond to a request for comment.

Uber’s valuation has now reached the high-water mark set by Facebook in 2011, when the social-networking company was nearly seven years old.

The ride-hailing company also is more highly valued relative to its revenue than Facebook was. At the time of its $50 billion round, Facebook had generated roughly $2 billion in revenue in the previous 12 months.

Analysis

Stephen Morgan, MD Europe at digital transformation company Squiz,said the valuation highlights the success that can come from disrupting an existing market

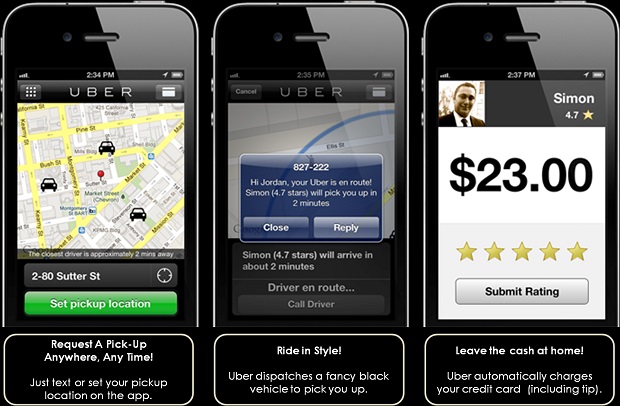

“Uber has reached this $51bn valuation because it’s a disruptor. It has completely changed the way consumers build relationships with service businesses; from its drivers being able to rate passengers to providing instant services through location technology. For big businesses, to achieve this sort of disruption in their market is an appealing but difficult challenge,” Squiz said.

“How do they turn around a steel tanker of a business when it’s weighed under with lengthy, corporate processes and the need to repeatedly hit monthly business goals? Working towards goals on such a short term basis makes it almost impossible for an organisation to innovate in the way that Uber has within the private hire sector. However, even the biggest businesses are able to compete with first to market start-ups if there is emphasis on ‘method’ as the most valuable measure of innovation. Innovation must be thought of within the process, not just as an end goal. When businesses value this they will see the case for longer term transformation projects.”