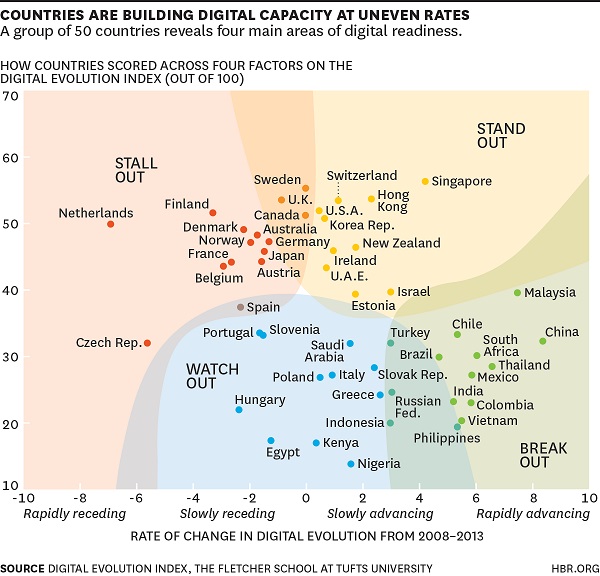

As digital technology becomes more accessible worldwide, which countries are most advanced and which are growing the fastest? This new chart from the Harvard Business Review takes an empirical look at the countries to watch (and which ones are losing out) in the new digital economy.

The Digital Evolution Index (DEI), created by the Fletcher School at Tufts University (with support from Mastercard and DataCash), is derived from four broad drivers:

• supply-side factors (including access, fulfillment, and transactions infrastructure)

• demand-side factors (including consumer behaviors and trends, financial and Internet and social media savviness)

• innovations (including the entrepreneurial, technological and funding ecosystems, presence and extent of disruptive forces and the presence of a start-up culture and mindset);

• institutions (including government effectiveness and its role in business, laws and regulations and promoting the digital ecosystem).

The resulting index includes a ranking of 50 countries, which were chosen because they are either home to most of the current 3 billion internet users or they are where the next billion users are likely to come from.

Singapore, Sweden and Hong Kong are seen as the biggest ‘stand ut countries, while China and Malaysia are identified as the biggest ‘break out’ countries.

Perhaps not surprisingly, developing countries in Asia and Latin America are leading in momentum, reflecting their overall economic gains.

But the analysis revealed other interesting patterns. For example, Singapore and The Netherlands are both among the top 10 countries in present levels of digital evolution. But the five-year rate of change from 2008 to 2013 indicates that the two countries are far apart.

Singapore has been steadily advancing in developing a world-class digital infrastructure, through public-private partnerships, to further entrench its status as a regional communications hub.

Through ongoing investment, it remains an attractive destination for start-ups and for private equity and venture capital.

The Netherlands, meanwhile, has been rapidly losing steam, according to the report. The Dutch government’s austerity measures beginning in late 2010 reduced investment into elements of the digital ecosystem. Its stagnant, and at times slipping, consumer demand led investors to seek greener pastures.

Based on the performance of countries on the index during the years 2008 to 2013, the Harvard Business Review assigned them to one of four trajectory zones: Stand Out, Stall Out, Break Out, and Watch Out

• Stand Out countries have shown high levels of digital development in the past and continue to remain on an upward trajectory.

• Stall Out countries have achieved a high level of evolution in the past but are losing momentum and risk falling behind.

• Break Out countries have the potential to develop strong digital economies. Though their overall score is still low, they are moving upward and are poised to become Stand Out countries in the future.

• Watch Out countries face significant opportunities and challenges, with low scores on both current level and upward motion of their DEI. Some may be able to overcome limitations with clever innovations and stopgap measures, while others seem to be stuck.