Digital marketing will make up half of all adspend in the UK during 2015, with UK growth outstripping US and Western Europe by 60%, according to new research.

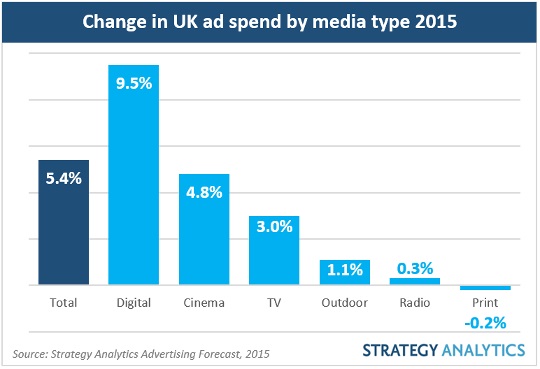

The study, from Strategy Analytics, indicates that digital adspend in the UK is set to grow fastest (9.5%) followed by cinema and TV. By contrast, the print only ad format is forecast to to decline.

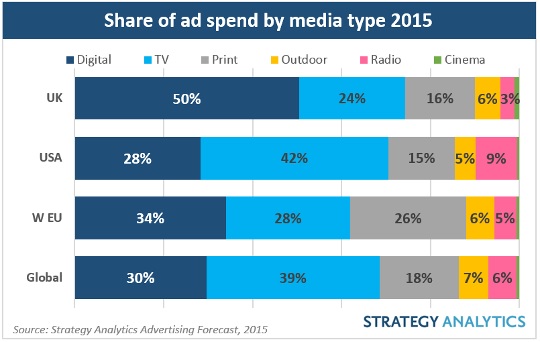

Nearly £8.0bn is forecast to be spent on digital advertising in 2015 – over twice that spent on TV (£3.8bn, 24% share). Print follows at £2.5bn (16%). Outdoor (£910 million), radio (£492m) and cinema (£179m) will account for the remaining 10%.

“Digital crossing the 50% share threshold is a seminal moment in the history of the ad industry, particularly factoring in its dominance in the UK compared to globally,” said Michael Goodman, co-author of Strategy Analytics’ report. “Digital accounts for a third of ad spend in Western Europe, 30% globally and just over a quarter in the US – where TV still rules the roost.

“However, TV’s declining share is actually less about ad pounds flowing out of TV and more about them flowing into digital from print and radio. Thus, broadcasters such as ITV, Channel 4 and Sky will see little, if any, real decline in revenues – just a shift in the source from linear TV ads to online video.”

By 2018, digital’s share (56%) in the UK will be two and a half times that of TV (23%). Goodman notes: “However, print will be the major casualty, falling to 12% market share in 2018 – less than a third it held a decade earlier.”

Growth

Online and mobile ad spend is forecast to grow 9.5% in 2015, compared to 1.6% for traditional advertising. UK ad spend, overall, is predicted to grow 5.4% to £15.8 billion.

After digital, cinema (4.8%) is the fastest growing ad format, then TV (up 3.0%). Outdoor will grow 1.1% and radio 0.3%.

Print is the only ad format forecast to decline in revenue, however, it’s also the only format whose 2015 growth rate (down 0.2%) is an improvement on 2014 (down 1.7%). For all other formats, growth rates in 2015 are lower than in 2014.

“UK ad revenue growth looks particularly strong, growing at a 60% faster rate than the US and Western Europe,” said Leika Kawasaki, co-author of the report. “It’s certainly more encouraging for print in the UK, with only a marginal decrease compared to a hefty 8% decline in the US and a 3% decline globally. However, outdoor (about 5 times less) and radio will experience much slower growth in the UK than globally.”

Digital ad growth will be driven mostly by mobile (23%), social media and video (both 18%). However, search will still command half of digital ad revenues in 2015.