App monetisation and programmatic availability as the most prevalent goals for app developers and publishers, according to a new report.

Millennial Media’s State of The Apps report is a global survey of application developers and publishers, seeking to get a pulse on the app economy.

Comparing the results to the survey run in 2013, the mobile ad marketplace was also were able to track year-over-year trends.

Highlights from the report include:

• 85% of developers and publishers monetise their apps and sites in some way, up 12 percentage points from the previous year. Of this, 82% use advertising, compared to 73% last year.

• 69% of developers and publishers make their inventory available programmatically, with the majority seeing an increase in revenue as a result.

• 33% of developers and publishers allow video ads to run in their apps, an increase of five percentage points from the previous year; 16% allow native ads.

The report, which surveyed 351 application developers and publishers from September through November of 2014, found that developers aim to design for multiple operating systems and devices, and to make their apps available on programmatic or digital marketing channels.

According to the report, 85% of developers and publishers monetize their apps and sites in some way (up 12% from the past year), while 69% of developers and publishers make their inventory available programmatically, with the majority seeing a resulting increase in revenue.

“From new app creation to new hires, developers and publishers around the world are citing ‘more’ as their 2015 goal,” said Matt Gillis, President of Platform at Millennial Media. “Our developer and publisher partners are recognizing the vast opportunities in supporting additional ad formats – such as video and native – and making inventory available through programmatic channels.

“This growing and healthy state of the app economy means significant benefits for advertisers. Brand advertisers are enjoying the availability of more high-quality inventory, and Direct Response advertisers have the opportunity to bridge messages across channels while obtaining high-value users.”

The report showcases top app categories for 2014 as well as the categories developers and publishers have their sights set on for the coming year.

The most popular app category is Games (86 percent), followed by Productivity & Tools (35 percent) and Music & Entertainment (19 percent).

The largest growth in 2015 is expected to come from Role Play/Character/Adventure/Strategy Games (up 12 percentage points from last year) and Health & Fitness (up 7 percentage points).

EMEA highlights:

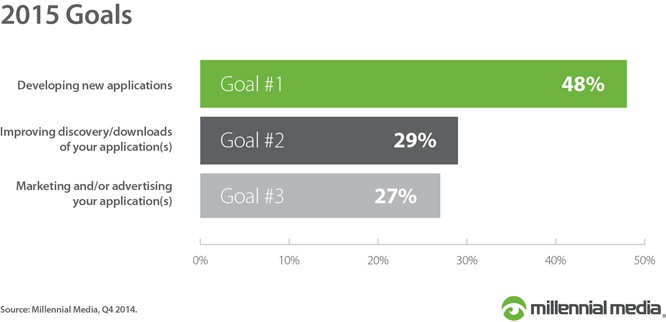

• EMEA developers’ main goal for 2015 is to develop new applications (42%), followed by marketing and/or advertising of their apps (31%) and improving discovery/downloads of apps (27%).

• Presently, only 41% of app developers in EMEA develop for iOS (vs. 97% Android), although that is expected to increase significantly to 68% in 2015; Windows, BlackBerry and mobile web apps will also see a jump of 12-13% each in 2015.

• Of developers and publishers in EMEA that monetise their apps, 88% do so through in-app advertising, 27% through paid app downloads and by in-app/virtual goods purchases.

To access the full report, click here: http://www.millennialmedia.com/mobile-intelligence/special-reports/.