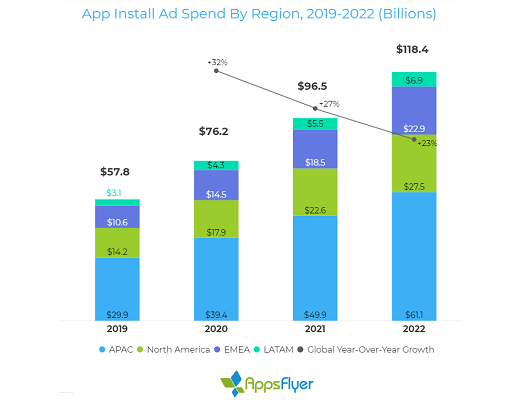

Global app install ad spend is set to reach $118 billion in 2022 as millions of people in the developing world come online, according to new research.

The upward trajectory will be fuelled by the growing number of app installs, projected to increase from 204 billion in 2019 to 258 billion in 2022, with key markets including China, India, Indonesia, and numerous countries in Africa experiencing a surge in app users. As a result, consumer spend in app stores alone reached $120 billion in 2019.

This projection is based on a predictive model, drawing on AppsFlyer’s own data which included over 30 billion non-organic installs, $48 billion in ad spend, and 72 thousand apps in a 2017-2019 sample.

In EMEA specifically, overall app install ad spend is projected to reach $22.9 billion in 2022 — up 106% compared to 2019. AppsFlyer also projects the average year-over-year growth in app install spend in Europe, Middle East and Africa will reach almost 30% through 2022.

The findings also show Europe presents a diverse landscape for ad spend. While Europe will add 16 million connected users by 2022 (only a 6% growth rate), Africa and MENA (Middle East and North Africa), will add no less than 60 million connected mobile users — growing at 20%, with Africa expected to grow twice as fast as MENA.

For marketers, app stores will become hyper-competitive environments where the odds of the average app being discovered organically in the app stores is almost non-existent.

“The share of budgets directed to acquiring new app users will increase faster than the actual increase in mobile search or brand budgets, demonstrating the growing role performance app marketing plays in mobile marketing,” said Shani Rosenfelder, Head of Content and Mobile Insights, AppsFlyer.

APAC and LATAM top the growth chart

Due to the mega markets of China, India, Indonesia, and Japan, Asia-Pacific commands the largest share of app install ad spend, with over half of global budgets through 2022. This region is expected to grow by 27% year-over-year through 2022. China is in a league of its own, with 900 million mobile internet users expected by 2022.

“Advances in market measurability have given us increased confidence to include China in the model for the first time despite the existing limitations in measurement,” Rosenfelder explained. “With an additional 100 million users, a conservative estimate suggests China app install ad spend will reach $15 billion in 2019 and over $22 billion in 2022.”

Similarly, app install ad spend across Latin America will remain robust, with Brazil leading the region at over 30% year-over-year growth through 2022 to reach almost $7 billion.

North America keeps competitive

By comparison, the North American base of connected mobile users will only grow 5% by 2022. The high lifetime value of the average user, in addition to its size, still means a positive growth forecast of 25% year-over-year to reach $27 billion in app install spend in 2022.

“The success of apps has attracted millions of developers to the app stores, creating a hyper-competitive environment. As a result, the chances of the average app being discovered organically in the app stores is almost non-existent. Apps must increase their marketing budget to draw attention to their app,” continued Rosenfelder.

Disparate markets in EMEA

Europe presents a more diverse landscape for ad spend. While Europe will add 16 million connected users by 2022 (only a 6% growth rate), Africa and MENA (Middle East and North Africa), will add no less than 60 million connected mobile users — growing at 20%, with Africa (Sub-Sahara) expected to grow twice as fast as MENA.

When it comes to Central and Eastern Europe, Russia stands above the rest. In fact, the country increased its share in the global app install pie in 2019 by 21% — representing the largest increase among the top 10 app markets.

However, the cost of media will stymie ad spend growth in several markets over the next three years. For example, the cost of media in Russia rests at $0.6-$0.7 per install. Even a 21% increase in its share in the global app install pie in 2019 doesn’t translate into massive spend – approximately $750 million in 2019.

By contrast, the UK and Germany led the way for Western Europe with approximately $1.8 billion and $1.4 billion spent on app install ads in 2019, respectively. A relatively high cost of media in these countries (approximately $2 per install), drives total spend upwards.

The projected growth of the global app market validates AppsFlyer’s own growth, coming on the heels of its $210 million Series D funding round led by General Atlantic, a leading global growth equity firm based in New York.

Click here for the full report

Methodology

The predictive model is primarily based on AppsFlyer’s own historical data set. Other parameters, such as third party mobile attribution market share data, cost per install prediction per region, number of apps in the app stores, and the number of installs were factored.