Consumers don’t trust the car industry, but great service offers brands a way to build long-term relationships and is changing the role of dealerships in driving loyalty, according to new research.

Large and emotionally-charged purchases make the automotive sector unique. They’re also what makes engagement in the industry so challenging. The latest research infographic from the DMA explores consumers’ top factors for choosing and engaging with an automotive brand.

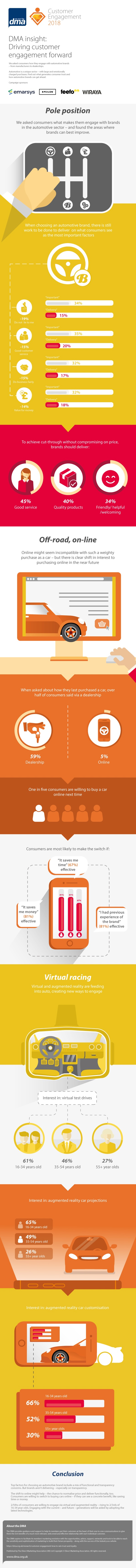

The survey asked consumers how they engage with automotive brands – from manufacturers to dealerships – as part of the latest Customer Engagement: Automotive report, sponsored by Emarsys, Epsilon, Feefo and Wiraya. Revealing that the most important factors for customers are good customer service (35%), not feeling they’re being lied to (34%), value for money (32%) and doing business fairly (32%).

However, brands aren’t currently delivering as well as consumers would like on some of these areas. The survey found room for improvement around not lying to customers (-19%) and doing business fairly (-15%), as well as providing good customer service (-15%) and value for money (-14%). To achieve cut-through without compromising on price, the research highlights brands should focus on delivering good service (45%), quality products (40%), and being friendly and helpful (34%).

“The car industry, like many who have gone before it, faces a changing landscape. Low trust levels and disruptive technologies present challenges that require a new approach,” said Rachel Aldighieri, MD at the DMA. “Consumers can now arrive at a dealership having already conducted their own research, which means dealerships are now shifting towards experience. At the same time, car brands need to ensure they are keeping pace with technological advances, using these to deepen and extend the customer experience. It’s up to brands and dealerships how they make sense of these changes, but what remains clear is that personal service is the most important factor for customers, it’s what builds trust and keeps them coming back.”

Online might seem incompatible with such a weighty purchase as a car, with just 5% of consumers having made a purchase digitally before, but there is clear shift in interest to purchasing online in the near future, as one in five are willing to buy a car online next time. Customers said they would be more likely to make the shift if they have previous experience with the brand (81%), it saves them money (81%) or time (67%).

Buying a car isn’t the same as it used to be, points out Scott Logie, Chair of the DMA Customer Engagement Committee and MD as REaD Group Insight: “For some consumers, the convenience of online outweighs the personal touch of face-to-face purchasing. Brands like Hyundai and Roadster are making buying totally online feasible: but they are complementing, rather than supplanting, the forecourt experience.”

Virtual and augmented reality are feeding into auto, creating new ways to engage. Interest in a virtual test drive, for example, is 61% among 16-34-year-olds, while nearly half (46%) of 35-54-year-olds showed interest and a quarter (27%) of those over 55. Similar interest was also found for use of augmented reality to project a car customers’ are interested in or the customisation options of a vehicle.

Overall, the top factors for choosing an automotive brand include a mix of functional and transparency concerns that brands aren’t currently delivering as well as they could. The shift to online might help and consumers are willing to try if they can see a concrete benefit, like saving time or money.

To read more about the DMA’s Customer Engagement research into the automotive sector, including the full report, visit: https://dma.org.uk/research/customer-engagement-focus-on-automotive