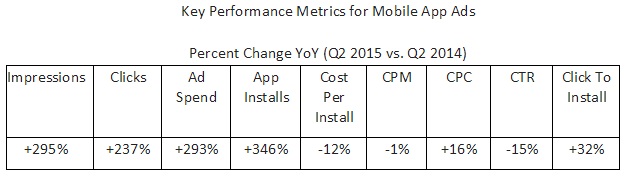

Advertisers globally are spending nearly four times more on Facebook mobile app ads than last year, used to promote mobile apps from Google Play and Apple app stores.

The research, from Kenshoo, also indicates that app installs from the mobile app ads increased by +346% year-on-year in Q2 of 2015.

The Mobile App Advertising Trends Q2 2015 study is based on a global dataset covering over $40 million (USD) in advertiser spend, and over 25 million app installs, targeted across over 100 countries worldwide.

While click-through rate is down YoY by 15% (see table below), the data shows that once a user has clicked on a social ad for a mobile app, just under 1 in 3 (30%) of those clicks turn into an actual app install.

Looking at costs, Kenshoo’s analysis highlights that the cost per click (CPC) for mobile app ads has increased YoY by +16% while the cost per thousand impressions (CPM) has been flat at -1%. At the same time, the increase in total app installs has driven Cost per Install (CPI) lower by -12%. This makes mobile app ads a more attractive proposition both because CPI reflects app marketers’ real goals and because CPI is more in line with how mobile app bidding algorithms are expected to change in future.

“With people spending increasing amounts of time on mobile devices, enterprises from a wide range of businesses sectors, including retail, financial services and media, as well gaming companies, have invested in developing mobile apps,” said Rob Coyne Kenshoo managing director for Europe Middle East & Africa (EMEA. “The challenge remains how to get consumers to discover, download, install and ultimately, to buy-in to the experience and continue to engage with apps. Mobile app ads are playing an important role here. The sizeable increase in mobile app ad spend reflects both an increase in the number of advertisers and increased spending from those advertisers. While competition is increasing, at the same time the Cost per Install from mobile app ads has actually gone down, making them more attractive.”

When comparing mobile app ad performance across operating systems, the data indicates that Android targeted ads are priced lower than iOS devices (the CPC on Android is $0.39 against $0.54 on iOS) although the gap appears to have narrowed since last year. The click-through rate gap between Android and iOS-targeted ads has also fallen in 2015, but Android still holds a slight edge when it comes to engagement – with a CTR of 1.3% (compared with 1.0% for iOS). When users click on an ad, those on Android are more likely to install an app than those on iOS (a click- to-Install rate of 31.5 % against 29.5%).

Analysing mobile app ad performance across app types suggests that the CPC for ads supporting consumer apps ($0.19) is lower than for gaming ($0.61) and other apps ($0.58). While the wider appeal of consumer apps may be the reason why ads drive a higher CTR (1.55%) than for gaming (0.97%) and other (1.17%) apps. However the likelihood that a user will actually install an app after clicking an ad (click-to-install rate) is 36% for gaming apps compared with 19% for consumer apps, implying that the broad appeal of consumer apps gives way to higher intent for gaming.

Looking at the amount of spend that is targeted at specific countries, the United States still accounts for the largest portion of targeted spend, and English-speaking countries make up the top four (the U.S. is highest, followed by U.K., Canada and Australia).

The Kenshoo Mobile App Advertising Trends Q2 2015 report can be downloaded from: Kenshoo.com/Mobile-App-Trends

Methodology

This report includes five quarters of data from April 2014 through June 2015, and reflects an aggregation of advertisers using the Adquant by Kenshoo platform that are Mobile-only and have defined a Mobile App Installation as a conversion.