78% of digital publishers view advertising revenue growth as a high strategic priority across the next year – a dynamic shift from the previous quarter, where no respondents cited it as high priority.

According to the latest quarterly Digital Publishers Revenue Index (DPRI) from the Association of Online Publishers (AOP) and Deloitte, this marks a clear refocus in digital strategies as publishers continue to adapt to the impact of COVID-19.

With 89% of publishers also prioritising non-advertising revenue growth, up from 60% this time last year, it is clear that all possible revenue streams are once again a key focus for publishers. Cost reduction is a high priority for 56% of publishers surveyed in the latest DPRI, in comparison to 33% a year earlier, as they concentrate on driving efficiency following a turbulent 2020.

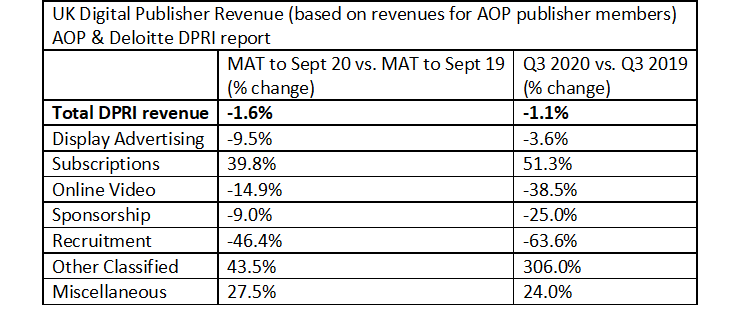

A majority (53%) of digital publishers witnessed positive revenue growth in Q3 2020, more than double that of the previous quarter (22%). This growth was driven in part by a significant rise in subscription revenue, which increased by 51.3% from Q3 2019 to Q3 2020. Despite this marked rise, the growth was offset by the year-on-year contractions in display (-3.6%) and online video (-38.5%) advertising, sponsorship (-25%), and recruitment (-63.6%). As a result, total digital revenue in Q3 2020 was £125.5mn, down by 1.1% in comparison to Q3 2019.

In the B2B sector, overall revenue experienced an increase of 4.1% in Q3 2020 compared to Q3 2019, and reached £11.7mn in Q3 2020, fuelled by an uptick in display advertising (15.2%), and subscription (5%) revenues. B2C publisher revenue, meanwhile, witnessed a decrease of 1.6% and fell to £113.7mn in Q3 2020 compared to the same quarter last year, but continues to be buoyed by a 68.3% rise in subscription revenue.

Following recovery from Q2 2020, confidence in the publishing industry has risen considerably, mirroring broader economic optimism following the announcement of vaccine efficacy in early November, shortly before respondents were polled. In light of expanded income streams, AOP board members were optimistic regarding their companies’ financial outlooks.

Richard Reeves, Managing Director, AOP, commented: “As the publishing industry starts to recover from the impact of the global pandemic, it is promising to see optimism continue to rise. While digital advertising remains the largest income stream for publishers, the positive growth of subscription revenue demonstrates how the industry has adapted to be stronger and more resilient in the face of the challenges posed by last year. However, it is interesting to note a returned focus on advertising revenue growth as a high strategic priority in the year ahead. Since the outbreak of Covid-19, news sites and premium publishers have attracted greater readerships with their trusted content; fresh opportunities to leverage this will no doubt arise as publishers make smarter decisions to support their bottom lines.”

Dan Ison, Lead Partner for Telecommunications, Media and Entertainment, Deloitte, commented: “That most publishers experienced revenue growth despite ongoing COVID-19 lockdown restrictions in Q3 2020 highlights the tenacity of the industry. Despite the disruption brought about by the pandemic, many online publishers were successful in building resilience within their organisations, investing in quality content that continued to drive a significant spike in subscription revenues. Amidst the vaccine roll-out and the signing of the Brexit trade deal, publishers should be optimistic for continued growth. However, we’re not yet out of the woods, with Deloitte’s latest CFO survey finding that half of CFOs think it will take until the last quarter of 2021 or later for their own revenues to return to pre-pandemic levels. As consumer confidence builds, so will the appeal of advertising for brands, and publishers must be quick off the mark to seize this opportunity.”