Tik Tok has surpassed Snapchat in time spent among adult users in 2020, according to new research from eMarketer.

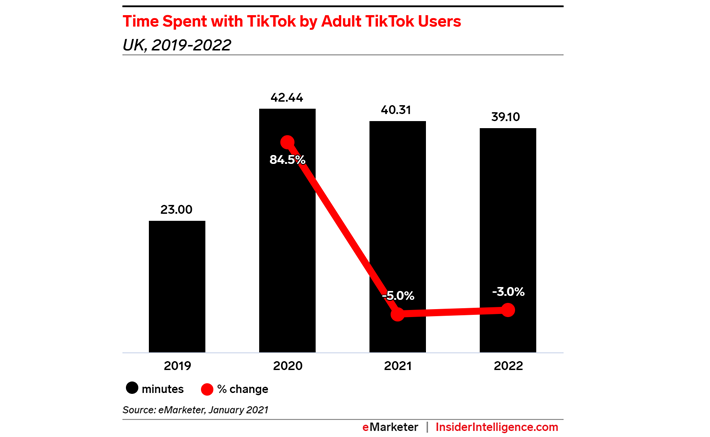

Last year, TikTok users spent 42.4 minutes per day on the platform, up from just 23.0 minutes in 2019. Meanwhile, Snapchat remained stagnant in 2020, at 24.6 minutes per day spent by the platform’s users. This year, we broke out figures for time spent with Instagram, Snapchat, and TikTok in the UK for the first time.

Please note that this forecast includes data for adults ages 18 and older. Currently, TikTok’s heaviest users are teens who are not included in this forecast.

Only Facebook enjoyed more time spent per average adult user in the UK last year, at 47.4 minutes per day, up slightly from 44.4 minutes in 2019. While Facebook still dominates the UK social network landscape, time spent by users in 2021 will decrease by 6.0%. Meanwhile, Instagram and Snapchat time spent among users will grow this year (up 3.5% and 0.1%, respectively)—and those increases are helped by their new short-form video features and creator content, such as Instagram’s Reels and Snapchat’s Spotlight, which emulate TikTok’s format. Though time spent with TikTok among UK users experienced huge growth amid the pandemic in 2020 (up 84.5%), that will decline by 5.0% this year as people return to more regular daily routines.

Due to the pandemic, we have increased our estimates for total social usage from those in our Q1 2020 forecast. The average adult social network user in the UK spent 93.5 minutes with social networks daily in 2020, up 19.0% over 2019. That will rise slightly to 93.6 minutes this year.

“Multiple stay-at-home orders through 2020 meant that lots of digital media saw a pandemic bump in terms of time spent, with social media chief among them,” said Bill Fisher, eMarketer senior analyst at Insider Intelligence. “But as those restrictions begin to ease through 2021, time spent on social networks will continue to edge up, albeit marginally. The efforts by social platforms to engage users with new features, particularly focused on video, will be one of the main reasons for this continued engagement.”

Methodology

eMarketer’s forecasts and estimates are based on an analysis of quantitative and qualitative data from research firms, government agencies, media firms and public companies, plus interviews with top executives at publishers, ad buyers and agencies. Data is weighted based on methodology and soundness. Each eMarketer forecast fits within the larger matrix of all its forecasts, with the same assumptions and general framework used to project figures in a wide variety of areas. Regular re-evaluation of available data means the forecasts reflect the latest business developments, technology trends and economic changes.