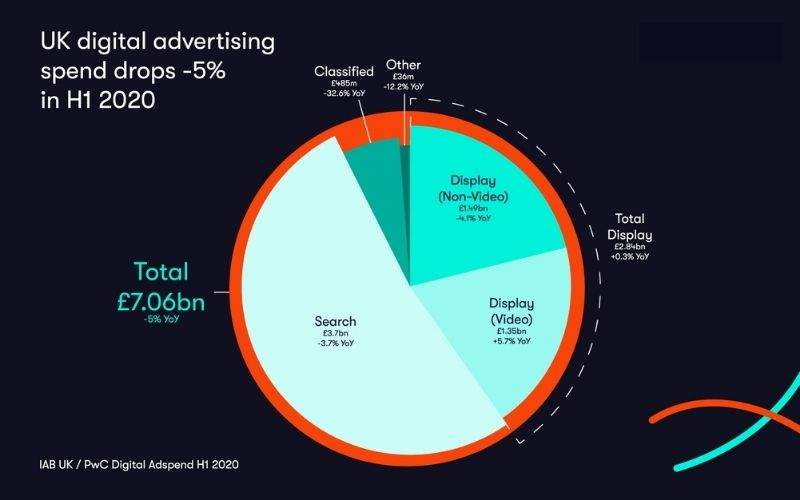

UK digital advertising spend dropped 5% in the first half of 2020, due to the impact of the Covid-19 pandemic, with most of the damage in the second quarter, according to new data from IAB UK and PwC.

While the fall was sharp, the digital advertising sector fared much better than the UK economy as a whole. In the second quarter of the year alone, UK GDP plummeted 20.4%, according to the Office for National Statistics.

Over the first half of the year, video and display ad spend still grew, with video up 5.7% year-on-year to £1.35bn and display increasing 0.3% to £2.84bn. Meanwhile, spend on mobile devices only suffered a 1% hit, falling to £3.85bn.

Elsewhere, investment in search ads slid 3.7% to £3.7bn, compared to the first half of 2019, and classified took a big 33% hit in tumbling down to £485m.

Missed chances to reach people online

The overall fall in the UK’s digital advertising spend can be attributed to uncertainty around the pandemic. However, advertisers may have missed out on many opportunities to reach people with the decision to reduce spend. Across the first half of 2020, time spent online in the UK was up 13% compared to the same period of 2019, as you would expect given the number of people either working from home or on furlough.

Jon Mew, IAB UK’s CEO, said: “It’s not surprising that this year has seen the total digital advertising market contract as our industry deals with the upheaval and uncertainty of the pandemic. The data released today is hugely useful in understanding the health of the digital ad market as a whole and how different areas are faring – yet we know that this continues to be a hugely challenging time for many of our members and that the relatively small decline in digital ad spend at an industry-wide level won’t reflect the individual situations of all,”.

“Yet there is cause for hope. Following 22 years of consecutive growth, the digital ad market went into this crisis in a position of strength and it’s great to see some areas of growth, despite the circumstances. Most importantly, digital advertising continues to drive results, build brands and offer unique creative solutions for advertisers looking to reach huge and engaged audiences.”

Industry comment

Mark Inskip, CEO UK & Ireland, Media Division, Kantar, said: “In the face of continued economic uncertainty, the digital ad market is plainly still feeling the squeeze. But it’s not all doom and gloom. It’s no surprise that video ad spend, for example, is up by 5.7% as consumers around the globe continue to turn on their trusty TV sets and sign up to Video on demand (VOD) services as they spend more time at home. Our TGI global quick view data shows that over half of consumers across 25 markets, including the UK, have used a streaming service “in the last week” so clearly the lift in spend is reflective of the huge, highly engaged audiences that can now be reached.

To get the most out of tight ad budgets as we head into an uncertain winter, it is important for marketers to be aware of both macro and local consumer trends and the evolving commercial opportunities that can be leveraged, as many countries are entering different stages of lockdown. Now more than ever, brands and advertisers must be strategic; they must identify key audience trends and stay up to date with developments around the world to carefully plan ad campaigns, ensuring that they digital ads are targeted at the right audience, with the right content, at the right time.”

Philippa Snare, SVP EMEA, The Trade Desk, said: “The 5% decrease in digital adspend is reflective of budgets tightening across the board due to the current economic climate. But with marketers scrutinising the performance of every pound, the value of digital advertising can only become clearer. In addition to the crucial ability to turn digital ads on and off at the flick of a switch, it allows marketers to both gain real-time insights into their audiences and to apply data to improve and optimise campaign performance.

“But perhaps most importantly of all, digital channels are where consumers are spending their time – whether for news, work or entertainment. And naturally, where consumers go, brands follow – and this is reflected in the number of marketers learning about and experimenting with new digital channels. Video revenue is one of the bright spots in today’s report – something we at The Trade Desk have seen with many agencies including Connected TV as part of their omnichannel campaigns for the first time.

“It is likely that these positive experiences of digital during the first half of the year will continue to drive improved spend in H2 and 2021. There remains uncertainty, but the brands that embrace digital and make the most of all that is has to offer will come out on top.”